iBet uBet web content aggregator. Adding the entire web to your favor.

Link to original content: https://www.scribd.com/document/102538079/Sample-Preliminary-Report

Sample Preliminary Report

Sample Preliminary Report

Sample Preliminary Report

_______________________________

Title Officer: Mark Taber Direct Telephone Line: (415) I-M-Title FAX Line: (415) fax-mark

SCHEDULE A The estate or interest in the land hereinafter described or referred to covered by this report is: A. A FEE Title to said estate or interest at the date hereof is vested in: B. Charles D. Byer and Elizabeth C. Byer, Husband and Wife, as Joint Tenants

The land referred to in this report is situated in the State of California, County of Anywhere, and is described as follows: C. Lot 17, Tract 53, in the City of Anytown, County of Anywhere, State of USA, as per map recorded in Book 789, Page 12 and 13, inclusive of Miscellaneous Maps, in the office of the County Recorder of said County.

D.

EXCEPT all oil, gas and hydrocarbon substances and other mineral rights, without however, the right to enter the surface of said land down to a distance of 500 feet from the surface thereof, as reserved in the Deed recorded October 11, 1955 in Book 5654, page 140 of Official Records.

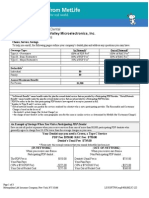

ORDER NO.: 77777 NOTES AND REQUIREMENTS (Continued) 3. (NOTE: The statement of information is necessary to complete the search and examination of title under this order. Any title search includes matters that are indexed by name only, and having a completed statement of information assists the Company in the elimination of certain matters which appear to involve the parties but in fact affect another party with the same or similar name. Be assured that the statement of information is essential and will be kept strictly confidential to this file.) NOTE NO. 4: Property taxes, including general and special taxes, personal property taxes, if any, and any assessments collected with taxes, for the fiscal year shown below are paid. For proration purposes the amounts are: Fiscal year 2000 - 2001 4. 1st Installment: 2nd Installment: Homeowners Exemption: Code Area: Assessment No.: NOTE NO. 5: 5. There are no conveyances affecting said land, recorded with six (6) months of the date of this report. NOTE NO. 6: 6. None of the items shown in this report will cause the Company to decline to attach CLTA Endorsement Form 100 to an ALTA loan policy, when issued. NOTE NO. 7: 7. There is located on said land a single family residence known as 123 Elm Street, in the City of Coastal Inlet, County of Anywhere, State of California, 99999. NOTE NO. 8: 8. The charge for a policy of title insurance, when issued through this title order, will be based on the short-term rate. (If this applies. Usually requires less than two years of ownership) $982.57 $982.56 NONE 01-003 123-456-78

ORDER NO.: 77777 SCHEDULE B AT THE DATE HEREOF EXCEPTIONS TO COVERAGE IN ADDITION TO THE PRINTED EXCEPTIONS AND EXCLUSIONS IN THE POLICY FORM DESIGNATED ON THE FACE PAGE OF THIS REPORT WOULD BE AS FOLLOWS: A. Property taxes, including general and special taxes, personal property taxes, if any, and any collected with taxes, to be levied for the fiscal year 1996-1997 which are a lien not yet payable. assessments

B. Supplemental or escaped assessments of property taxes, if any, assessed pursuant to the Revenue and Taxation Code, of the State of the USA. 1. An easement for the purposes shown below and rights incidental thereto as shown or as offered for dedication on the recorded map shown below. Map of: Tract 56 Purpose: Pipeline Affects: The Southerly 10 feet of said land 2. An easement for the purpose shown below and rights incidental thereto as set forth in a document Granted to: Southern California Edison Company Purpose: Public utilities Recorded: March 6, 1969 in Book 4798, Page 368 of Official Records Affects: the Northerly 6 feet of said land 3. An easement for the purpose shown below and rights incidental thereto as set forth in a document Granted to: General Telephone Company Purpose: Pole lines Recorded: June 15, 1970 in Book 4850, Page 114 of Official Records Affects: The exact location and extent of said easement is not disclosed of record Note: If a CLTA Form 103.3 Endorsement with respect to said easement is desired, please advise so that a determination can be made whether such endorsement can be issued. 4. Covenants, conditions and restrictions (deleting therefrom any restrictions based on race, color or creed) as set forth in the document. Recorded: July 15, 1970 in Book 4855, Page 112 of Official Records Said covenants, conditions and restrictions provide that a violation thereof shall not defeat the lien of any mortgage or deed of trust made in good faith and for value. Modification(s) of said covenants, conditions and restrictions Recorded: October 10, 1971 in Book 4901, Page 110 of Official Records ORDER NO.: 77777 SCHEDULE B (continued)

5. A Deed of Trust to secure an indebtedness in the amount shown below, and any other obligations secured thereby Amount: $200,000.00 Dated: October 10, 1991 Trustor: Charles D. Byer and Elizabeth C. Byer, husband and wife Trustee Title Insurance Company, a California Corporation Beneficiary: Fly-By-Night Savings and Loan Association, a California corporation Recorded: October 20, 1991 as Instrument No. 91-611311 of Official Records An assignment of the beneficial interest under said deed of trust which names As Assignee: Gooddeed Savings and Loan Association, a corporation Recorded: January 5, 1992 as Instrument No. 92-0003546 of Official Records 6. A Deed of Trust to secure an indebtedness in the amount shown below, and any other obligations secured thereby Amount: $40,000.00 Dated: October 10, 1991 Trustor: Charles D. Byer and Elizabeth C. Byer, husband and wife Trustee: Title Insurance Company, a California corporation Beneficiary: Your Friendly Credit Union Recorded: October 20, 1991 as Instrument No. 91-611312 of Official Records A Notice of Default under the terms of said deed of trust Executed by: Your Friendly Credit Union Recorded: April 15, 1993 as Instrument No. 93-0112456 of Official Records A Substitution of Trustee under said deed of trust which names as the substituted trustee, the following Trustee: Title Insurance Company, a California corporation Recorded: April 15, 1993 as Instrument No. 93-0112457 of Official Records 7. An abstract of judgment for the amount shown below and any other amounts due. Debtor: Charles D. Byer and Elizabeth C. Byer Creditor: Cool Pool Inc., a state corporation Dated entered: May 5, 1992 County: Bay Area Court: Central court of Anytown Case No.: AO3914 Amount: $2,365.30, plus interest and costs Recorded: June 17, 1992 as Instrument No. 92-214567 of Official Records

8. A tax lien for the amount shown and any other amounts due, in favor of the United States of America, assessed by the District Director of Internal Revenue. Federal Serial No.: 93641 Taxpayer: Charles D. Byer and Elizabeth C. Byer Amount: 936.40 Recorded July 15, 1993 as Instrument No. 93-21568 9. A tax lien for the amount shown and any other amounts due, in favor of the State of California. Amount: $320.45 Filed by: State Board of Equalization Taxpayer: Charles D. Byer and Elizabeth C. Byer Certification No.: 73492 Recorded: August 1, 1993 as Instrument No. 93-216789 10. A lien for unsecured property taxes filed by the tax collector of the county shown, for the amount set forth, and any other amounts due. County: Bay Area County Fiscal Year: 1992-1993 Taxpayer: Charles D. Byer and Elizabeth C. Byer County Identification No.: 513456 Amount: $193.60 Recorded: August 15, 1993 as Instrument No. 93-217890 of Official Records 11. A judgment lien for child support. Debtor: Recorded: Case No.: Filed by: Amount:

John G. Martinez June 1, 1986 as Instrument No. 86-771320 86-220-971 County of Greenville None given

END OF SCHEDULE B IMPORTANT INFORMATION PLEASE REFER TO THE NOTES AND REQUIREMENTS SECTION" FOR ANY INFORMATION NECESSARY TO COMPLETE THIS TRANSACTION

Plat Map