Disclaimer: Any opinions expressed below belong solely to the author.

Binance’s legal saga with the US authorities appears to be coming to an end as the company has reportedly agreed to pay a massive fine of US$4.3 billion while its founder and CEO, Changpeng Zhao, stepped down yesterday — likely to avoid a possible prison sentence — and is expected to pay an additional criminal fine of US$150 million.

CZ reportedly told his employees that it was “better to ask for forgiveness than permission”, and failed to comply with US laws, allowing billions in transactions with sanctioned countries (Iran, Cuba, Syria and Russian-occupied regions of Ukraine), terror groups like Hamas’ Al-Qassam Brigades, Palestinian Islamic Jihad (PIJ), Al Qaeda, and the Islamic State of Iraq and Syria (ISIS), as well as criminal organisations, which used the platform to launder ill-gotten money from their activity around the world.

Not only did the company fail to control who is using the platform, but on occasion, provided advice to certain VIP users at risk of suspension on the basis of the sources and volumes of their transactions, making Binance directly complicit in criminal activity.

This is the crux of the indictment against the company, which was unsealed before US Attorney General Merrick Garland’s conference yesterday.

From NTU, MAS, and SGX to Binance

The settlement mandates that the company appoints a compliance monitor to ensure it abides by its terms and adheres to American laws. It also cost CZ his executive role in the company and barred him from involvement with its business operations until three years after the monitor’s appointment.

As a result, Binance’s founder announced his resignation on X later in the day:

Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.

— CZ ? Binance (@cz_binance) November 21, 2023

Binance is no longer a baby. It is…

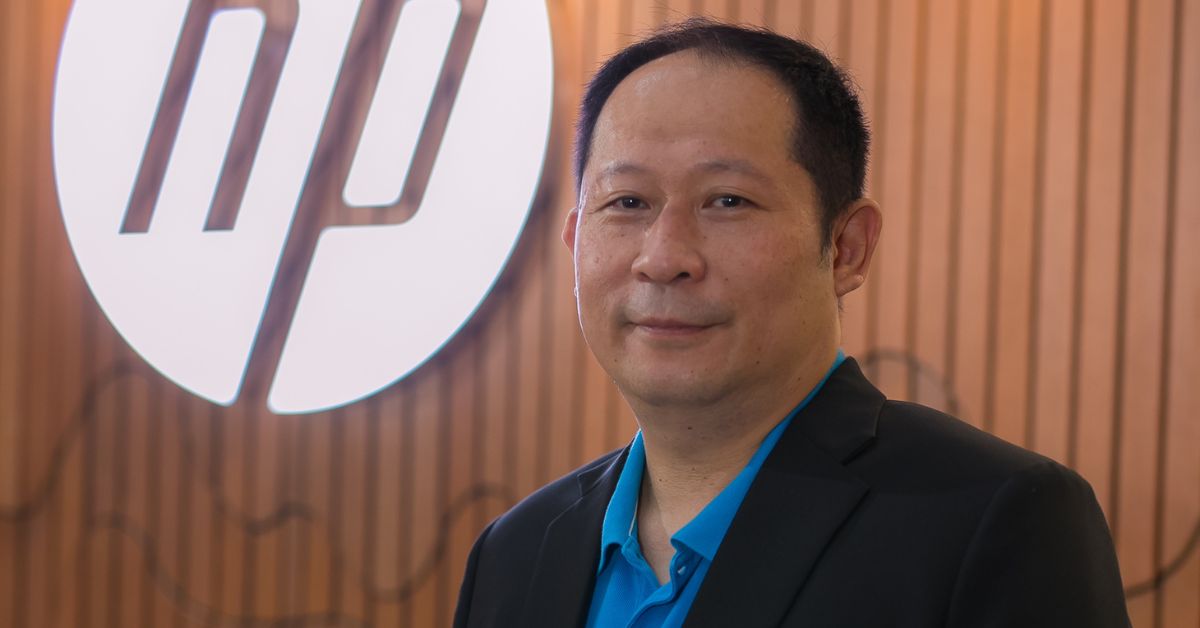

His replacement is Richard Teng, a Singaporean who joined the company in 2021 as the CEO of its Singapore business before moving up to become the global Head of Regional Markets.

His career started with an accountancy degree from Nanyang Technological University (NTU), back in 1994, followed by a Masters in Applied Finance from the University of Western Australia.

Upon completing his studies, he joined the Monetary Authority of Singapore (MAS) for a successful 13-year stint, during which he ascended to the role of Director of Corporate Finance before transferring to the Singapore Exchange (SGX) as Chief Regulatory Officer between 2007 and 2015.

After leaving Singapore and immediately before joining Binance six years later, he served as the CEO of the Abu Dhabi Global Market financial centre, which, during his tenure, began attracting crypto companies seeking to operate out of the UAE.

It’s quite likely that it is his background in financial regulation, having experience with the inner workings of Singapore’s central bank as well as SGX, where he was charged with regulatory matters opposite MAS, that made him an excellent candidate to take over at the helm of Binance during a time of great turmoil caused by loose adherence to American laws.

What Binance, still the king of crypto exchanges, needs now is some tranquility, and the new CEO seems to be very well-positioned to deliver it.

CZ may have been right in the end

While having to pay US$4 billion in fines may sound like a harsh penalty, it may very well be that Binance’s founder was right about “asking for forgiveness” instead of permission in the end.

Even if the amount both he and the company have to cough up is larger than the money made from various illegal transactions, they have certainly contributed to Binance’s popularity and added trading volume to its figures, making it appear larger than it otherwise would have been, adding to its perceived value.

The ruthless logic of business surely was that if they didn’t take that piece of the cake, then somebody else would. Given that Binance remains in business and CZ himself was only suspended from engaging with it for three years — while retaining his stake making him worth over US$10 billion — it seems that the settlement is really just a slap on the wrist. Maybe a bit stronger than usual, but little more than that.

It’s going to be interesting to see if this case ends up encouraging rather than deterring illegal behaviour among fintech founders, seeing how you can get away with paying your way out of trouble once you become big enough.

Featured Image Credit: ADGM