iBet uBet web content aggregator. Adding the entire web to your favor.

Link to original content: https://stripe.com/en-hr/use-cases/global-businesses

Stripe powers adaptive enterprises around the world, including dozens of industry leaders processing billions in annual payment volume. We help companies simplify global expansion, optimise their payments infrastructure, and easily add new business models and revenue streams.

Accept payments from customers around the world with cardholder support in more than 195 countries. Offer dozens of local payment methods to improve conversion rates and create better experiences for your customers. Let Stripe handle complex regulatory nuances for each new country so you can focus on your core business.

Learn more about which payment methods are supported in specific countries.

Stripe lets you accept, store, manage, and pay out money globally with a single integration. Stripe maximises revenue for businesses by improving authorisation rates on every payment and reducing declines with powerful machine learning.

Stripe is constantly improving, scaling issuer-specific authorisation optimisation with Adaptive Acceptance.

Stripe will also help you increase revenue with built-in features such as machine learning retries and take advantage of local Stripe acquiring to increase acceptance rates and reduce costs.

Global companies rely on Stripe for industry-leading uptime and performance. We continually deploy improvements to our platform, which handles more than 200 million business-critical API requests every day.

Our platform processes payments around the world and is built to help you adapt as rules change – from PCI certification to SCA-ready payments. Our unified product suite also helps you tackle fraud, issue cards, set up recurring billing, or even integrate in-store payments with your online stack.

Stripe was named a Leader with the highest possible score in 16 criteria in The Forrester Wave™: Merchant Payment Providers, Q2 2022 report.

Ford Motor Company and Stripe have partnered to scale the manufacturer’s e-commerce capabilities faster and to deliver an always-on experience for Ford and Lincoln customers.

Ford CEO Jim Farley made it clear when he took over the top spot at the vehicle manufacturer in October 2020 that one of his biggest focuses would be on connected vehicle services.

Ford will use Connect to facilitate a customer’s payments to a correct local Ford or Lincoln dealer. As Ford develops e-commerce offerings across the product and service spectrum, Stripe’s platform and services are expected to drive new efficiency into processing of e-commerce payments, such as vehicle ordering, reservations and digital and charging services.

Stripe has developed strong expertise in user experiences that will help provide easy, intuitive and secure payment processes for our customers.

As one of the most popular e-commerce platforms in the world, WooCommerce enables WordPress businesses to sell and manage orders directly from their websites.

WooCommerce wanted to help its merchants adapt quickly to changing consumer habits through its own integrated payments solutions.

WooCommerce decided to launch a brand new platform, WooCommerce Payments, by integrating several different Stripe products to enable merchants to do everything from taking contactless payments and accessing funds in real time to tapping into business funding to keep operations afloat. In just three months and with a team of fewer than 20 people, the company partnered with Stripe to launch WooCommerce Payments in 17 countries – from Canada to New Zealand and across Europe.

Building on Stripe, we started with payments, billing and subscriptions. But we’re quickly adding Stripe Terminal for in-person payments, and planning to offer a full suite of fintech services to help our merchants grow their business, including access to capital and more – not only in the US, but also Europe and other regions where WooCommerce thrives. We chose Stripe because its extensive options across payments and financial services are what enable us to do this, and do it rapidly without compromise.

Microsoft-owned GitHub is a code management platform that was looking for a partner to help it launch Github Sponsors to support open-source developers.

GitHub wanted to create a compliant and seamless onboarding experience that is accessible to the developer community in various languages around the world. Once onboarded, anyone on the Sponsors platform can sponsor a developer contributing to an open source project – and GitHub can match it up to $5000 per developer.

GitHub used Stripe to onboard developers in 34 countries to accept donations. In two months, Stripe helped GitHub reduce a manual 9-step, week-long process to a fully localised, 2-minute onboarding experience. It also expanded support to more countries and currencies without additional work.

We are extremely happy customers, and Stripe makes it possible for us to build new products like GitHub Sponsors that would be nearly unthinkable without them.

Nasdaq is a global technology company democratising access to the capital markets. It owns and operates several stock exchanges across the US and Europe. Nasdaq chose Stripe for robust security and scalability.

After making several acquisitions, Nasdaq knew it needed a payments provider that would allow it to work securely across its subsidiaries and assist in improving its recurring billing and financial reporting.

Stripe Payments allowed Nasdaq to provide simple and secure card payment options, while Stripe Billing gave the Nasdaq team a flexible way to bill their customers on a recurring basis, including accepting alternative payment methods. Nasdaq will continue to grow its software solutions with the trust of Stripe’s leading security infrastructure.

Scalability and security are two key areas of focus in operating all of our solutions. That is why we chose Stripe. We saw Stripe as the most secure provider.

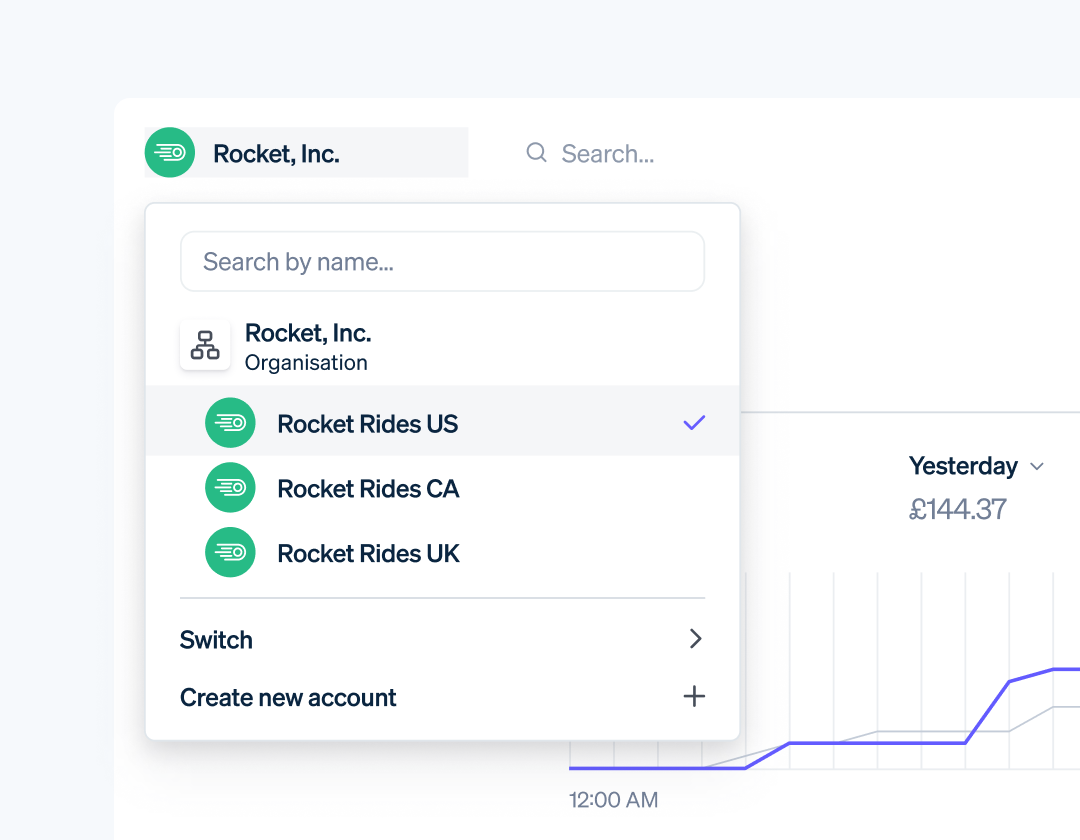

With Stripe Organizations, centrally manage all lines of business or subsidiaries across multiple Stripe accounts in the Dashboard—no matter where in the world you do business.

We partner closely with you from onboarding to deployment, offering 24x7 phone, email and chat support, dedicated technical account management, support in your Dashboard, and personalised recommendations for your business goals. Let’s get started.

Learn how 600 global chief executives are unlocking new revenue streams and growth opportunities.

Stripe is the highest scoring payments provider – recognized for its scale, technology and speed of innovation.