iBet uBet web content aggregator. Adding the entire web to your favor.

Link to original content: https://stripe.com/en-ca/enterprise

historical uptime for Stripe services

category leaders processing over $1B in annual payment volume on Stripe

API requests per day processed by Stripe

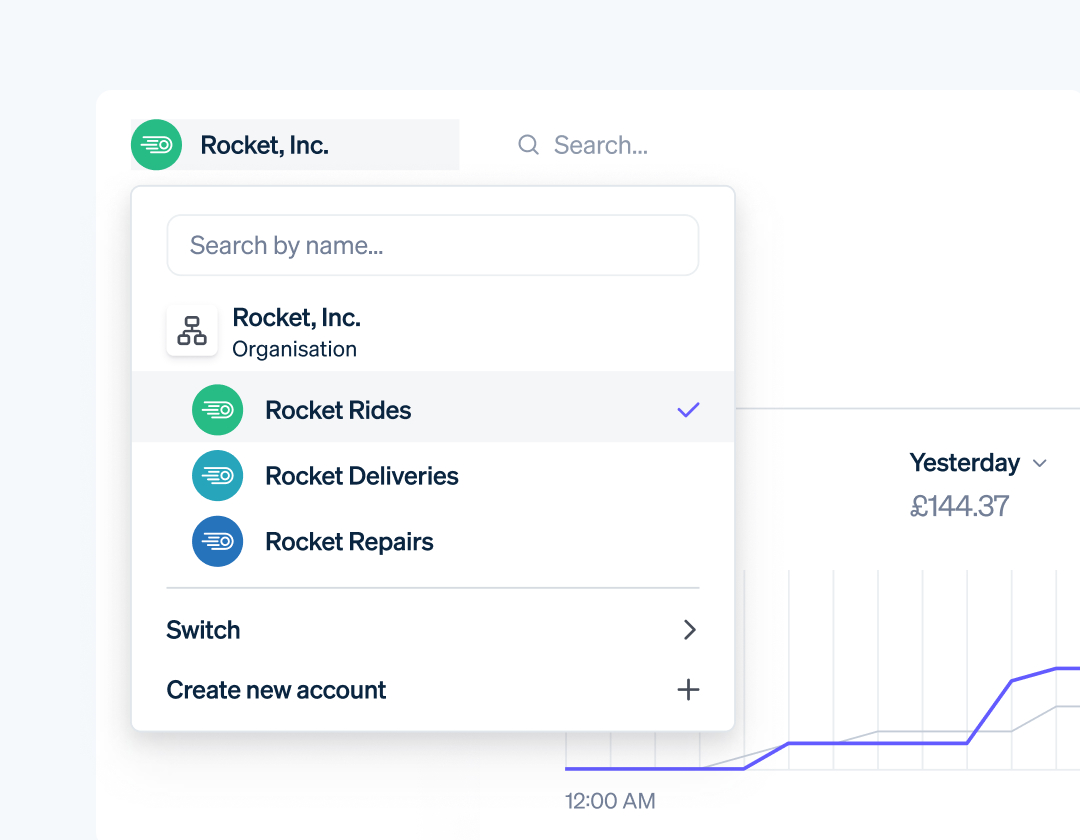

Centrally manage all lines of business or subsidiaries across multiple Stripe accounts in the Dashboard with Stripe Organisations.