NEWS FEED

Celebrate the Holidays in Delaware with the Hidden Holiday Gems Passport

Date Posted: November 22, 2024

Governor Carney Proclaims November 17-23 as Delaware Apprenticeship Week

Date Posted: November 22, 2024

Delaware Office of Highway Safety Launches Sober Rides Initiative and Kicks Off Winter Holiday Road Safety Campaign

Date Posted: November 21, 2024

Governor Carney, DSB Announce Fall 2024 EDGE Grant Competition Awards

Date Posted: November 20, 2024

City Of Wilmington Celebrates Ten Years Of Downtown Development Districts

Date Posted: November 20, 2024

Division of Revenue Releases Guidance on New Short-term Rental Lodging Tax

Date Posted: November 20, 2024

DOJ secures life plus decades more in prison for domestic violence repeat offender

Date Posted: November 19, 2024

Federal Court Orders Harris Jewelry to Restore its Website and Portal for Servicemembers to Request Refunds

Date Posted: November 19, 2024

Agriculture, Food and Natural Science Students Take Home Awards from 97th National FFA Convention & Expo

Date Posted: November 19, 2024

Delaware Forest Service To Host Upcoming Wildfire Training

Date Posted: November 18, 2024

Delaware’s Sports Tourism Industry Contributed Significant Economic Impact in 2023, According to Recent Study

Date Posted: November 15, 2024

Delaware Celebrates Improvements To The Housing Assistance Application Process

Date Posted: November 15, 2024

Delaware Natural Resources Police Collecting Toys for Tots Donations for Kids

Date Posted: November 15, 2024

Delaware State Housing Authority Recognizes Mortgage Lending Community And Veterans At 2024 Annual Lender Meeting

Date Posted: November 14, 2024

Delaware Officials Unveil Harm Reduction Vending Machines

Date Posted: November 14, 2024

2025 District/Charter Educational Support Professionals of the Year Honored

Date Posted: November 14, 2024

Historical Marker Dedicated – Mount Olive Holiness Pentecostal Church in Smyrna

Date Posted: November 13, 2024

DelDOT Receives Top Bond Rating and Announces Bond Sale

Date Posted: November 12, 2024

Delaware’s Education Savings Plan Earns Silver Rating

Date Posted: November 7, 2024

Delaware Schools Receive National, State Honors

Date Posted: November 6, 2024

DNREC to Host Nov. 14 Webinar about Storm Water Management and Living Shorelines

Date Posted: November 6, 2024

Governor Carney Releases Government Efficiency and Accountability Review (GEAR) Board Report

Date Posted: November 4, 2024

DOJ secures conviction in the killing of Cynthia Amalfitano

Date Posted: November 4, 2024

AG Jennings and bipartisan coalition of 30 states announce finalization of settlement with Kroger over opioid crisis

Date Posted: November 4, 2024

Carney Administration Outlines Investments in Electric Vehicle Infrastructure

Date Posted: November 1, 2024

Open Enrollment on Delaware’s Health Insurance Marketplace Starts Nov. 1

Date Posted: November 1, 2024

AG Jennings Announces Cooperation Agreements and Settlements with Heritage and Apotex totaling $49.1 Million

Date Posted: November 1, 2024

DNREC Reopens Castle Trail Along C&D Canal Following Repairs to Storm-Damaged Section

Date Posted: October 31, 2024

Delaware Partners with American Cancer Society for 2nd Annual Lung Cancer Screening Campaign

Date Posted: October 31, 2024

OMC Provides Update on License Lottery and Selected Applicants for Delaware’s Marijuana Industry

Date Posted: October 31, 2024

Funding Awarded for Tree-Planting Projects

Date Posted: October 31, 2024

With Annual Fall Trout Stocking in White Clay Creek, DNREC Delivers Angling Opportunities

Date Posted: October 30, 2024

Carney, Carper, Coons, Blunt Rochester Announce Over $127 Million in Federal Funding to Decarbonize Port Wilmington

Date Posted: October 30, 2024

Governor Carney Launches Statewide Student Mentoring Program

Date Posted: October 29, 2024

DPH Oral Health Screening Programs Support Students’ Healthy Smiles and Expand Access to Dental Care

Date Posted: October 29, 2024

Opioid Fund Co-Chairs Release Roadmap to Recalibrate Use of Settlement Funds

Date Posted: October 28, 2024

New HSCA Rate Goes into Effect in January

Date Posted: October 28, 2024

AG Jennings resuspends financial advisor for illegally accessing former clients’ account information

Date Posted: October 28, 2024

DOJ secures more than two decades of prison time in cold case murder

Date Posted: October 28, 2024

Housing Assistance Applicants Should Update Information On Public Housing Waitlists By Nov. 22

Date Posted: October 28, 2024

Delaware Forest Service Opens Grants for Local Communities

Date Posted: October 28, 2024

Office of the Marijuana Commissioner (OMC) Conducts Lottery for Delaware’s Regulated Marijuana Industry

Date Posted: October 25, 2024

Governor Carney, with Guidance from Water Supply Coordinating Council, Declares Statewide Drought Watch

Date Posted: October 25, 2024

Tag-A-Palooza 2024

Date Posted: October 24, 2024

Office of the Marijuana Commissioner: Licensing Lottery

Date Posted: October 23, 2024

AG Jennings issues open letter to Delaware landlords urging Delaware Landlord/Tenant Code Compliance

Date Posted: October 22, 2024

New Housing Vouchers for Delaware Families

Date Posted: October 21, 2024

Piping Plover Population in Delaware Experiences Slight Decline, Offset by Higher Nesting Success

Date Posted: October 21, 2024

National Slow Down Move Over Day Observed as Delaware Sees Near Record Crashes

Date Posted: October 18, 2024

Delaware Officials Unveil New Sign to Celebrate Delaware’s Agricultural Lands Preservation Program

Date Posted: October 17, 2024

DOJ secures prison time for former trooper

Date Posted: October 16, 2024

Colonial Teacher Named Delaware 2025 Teacher of the Year

Date Posted: October 15, 2024

Governor Carney Orders Lowering of Flags

Date Posted: October 15, 2024

Delaware Faces Dry Conditions: Open Burning Ban Issued, Water Conservation Urged

Date Posted: October 15, 2024

Burning Ban

Date Posted: October 15, 2024

DelDOT Announces 4th Annual Name That Plow Contest

Date Posted: October 15, 2024

Potassium Iodide Distribution on October 24 in Townsend

Date Posted: October 15, 2024

DPH Releases Latest Cancer Incidence and Mortality Trends in Delaware

Date Posted: October 14, 2024

Navarro Announces Eighth Consecutive Workers’ Comp Rate Decrease

Date Posted: October 14, 2024

Governor Carney Statement on Honorable James T. Vaughn, Jr.’s Passing

Date Posted: October 11, 2024

Delaware Celebrates $14.3 Million Climate Grant for I-95 Charging Infrastructure

Date Posted: October 10, 2024

AG Jennings Announces $52 Million Multistate Settlement with Marriott for Data Breach

Date Posted: October 10, 2024

First Spouse Tracey Quillen Carney, Delaware DOE, Delaware Readiness Teams Kick off Kindergarten Registration

Date Posted: October 9, 2024

Delaware Board of Pardons Reforms Support Second Chances

Date Posted: October 9, 2024

Look Out for Deer Crossing Roads During Mating Season, Delaware Authorities Caution Drivers

Date Posted: October 9, 2024

Governor Carney to Activate Delaware National Guard to Assist with Florida’s Hurricane Response

Date Posted: October 8, 2024

Food Bank, Lt. Gov. Hall-Long Coordinate Infant Formula, Supplies for Hurricane Helene Relief

Date Posted: October 8, 2024

Highmark Exam Results In Mental Health Parity Penalties

Date Posted: October 8, 2024

Governor Carney Statement on Former Mayor Ted Becker’s Passing

Date Posted: October 7, 2024

Fire Prevention Month 2024

Date Posted: October 6, 2024

2024 General Election Voter Registration Deadline is Saturday, October 12, 2024 at 11:59 p.m.

Date Posted: October 4, 2024

OMC Receives More than 1,000 Applications for Licenses and Prepares for the Lottery Process

Date Posted: October 3, 2024

Blackbird Creek Fall Festival Set For October 19

Date Posted: October 3, 2024

Medicare Assistance Bureau: Important Reminders Ahead of Open Enrollment

Date Posted: October 3, 2024

National Endowment for the Arts Announces $12 Million in Grants to Expand Access to Arts in Communities Nationwide

Date Posted: October 2, 2024

Delaware EARNS Registration Deadline Approaching

Date Posted: October 2, 2024

The Mezzanine Gallery to Exhibit Brandan Henry’s “Ebon Solus”

Date Posted: October 2, 2024

Delaware’s AP Success: Advancing Equity and Excellence

Date Posted: October 2, 2024

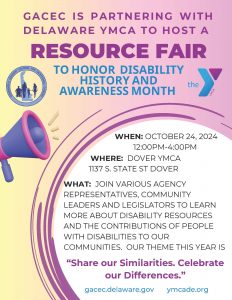

GACEC Partnering with Delaware YMCA to Host Resource Fair

Date Posted: October 1, 2024

McMaster Technique Offers Delaware Livestock Producers and Veterinarians More Options in Herd Health

Date Posted: October 1, 2024

DSHA Launches Landlord Incentive Program to Expand Housing Opportunities for Voucher Holders

Date Posted: October 1, 2024

Governor Carney Signs State Retiree Health Care Benefits Legislation

Date Posted: September 30, 2024

Delaware sends swift water team to North Carolina

Date Posted: September 30, 2024

Community Engagement Sessions for Delaware Climate Action Plan Update Planned

Date Posted: September 30, 2024

Delaware Division of the Arts and DETV Launch “Arts Alive Delaware” TV Series

Date Posted: September 26, 2024

Delaware Office of Highway Safety Announces New Campaign to Increase Safety on Delaware Roadways

Date Posted: September 26, 2024

15 DNREC Programs to Participate in UD’s Annual Coast Day

Date Posted: September 26, 2024

Bridge Damage to Require Extended Lane Closure on Route 896 South

Date Posted: September 25, 2024

DNREC Study Finds PFAS in Surface Water Samples

Date Posted: September 24, 2024

Two Delaware Schools Named 2024 National Blue Ribbon Schools

Date Posted: September 23, 2024

Five Schools Earn State School Counseling Award

Date Posted: September 23, 2024

Governor Carney Vetoes House Bill 140

Date Posted: September 20, 2024

First Spouse Tracey Quillen Carney Recognizes September as Literacy Month, Continues Reading Tour

Date Posted: September 19, 2024

Event at the Delaware Public Archives: Tales from the Vaults

Date Posted: September 19, 2024

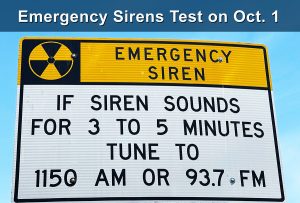

Emergency Sirens Test on October 1

Date Posted: September 19, 2024

Delaware Brings Private Paid Family Medical Leave Policies to Market

Date Posted: September 19, 2024

DNREC Accepting Community Water Quality Improvement Project Grant Proposals

Date Posted: September 18, 2024

DNREC to Hold Community Information Session Sept. 24 on Indian River Inlet North Side Beach and Dune Repair

Date Posted: September 18, 2024

State Auditor’s Office Issues First Audit of Dual Employment of Government Officials Since 2017

Date Posted: September 17, 2024

Overdose Review Commission releases 2023 annual report

Date Posted: September 17, 2024