Abstract

The world witnessed unprecedented growth of digitalisation, especially the rise of digital banking with a more robust ecosystem. Salient discussions are widely done by consumers, marketing society, e-commerce, banking and fintech industries, regulators and literature experts. This research critically evaluates the evolution of the retail consumer behaviour model arising from digitalisation with an in-depth study of variables closely associated with consumer behaviour in the Singapore market. The research philosophy used in the current study is Critical Realism based on ontology. Descriptive research is used in the present study to examine the situation as it exists in the current state of the effects of digitalisation on consumers. The study is a cross-section analysis with a deductive approach. Data is collected through a web-based questionnaire with a sample size of 200, selected using a non-probabilistic convenience sampling method. Various statistical analysis tools, including Descriptive Analysis, ANOVA (Analysis of Variance), Pearson’s correlation coefficient test and inferential statistics tools like a simple linear regression test, were applied and presented. Hypotheses related to perceived risks, perceived values, and various attributes, namely social groups, intention, attitude and emotion correlation with digital consumer purchase behaviour, are also studied and tested. The findings highlight that perceived risk, perceived values and emotion elements positively impact digital consumer behaviour. Notwithstanding that, it is pivotal to point out that these independent variables are not correlated with the rationale of consumers. Recommendations suggested providing deeper insights into measures for consumer protection against the threats of digitalisation.

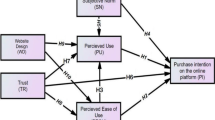

(Source: Developed for this research study)

Similar content being viewed by others

Data availability statement

The authors confirms that all data generated or analysed during this study are included in this published article.

References

Balconi M, Natale MR, Benabdallah N, Crivelli D (2017) New business models: the agents and inter-agents in a neuroscientific domain. Neuropsychol Trends 21:53–63

Bommel Van E, Edelman D, and Ungerman K (2014). Digitising the consumer decision journey. McKinsey & Company. Retrieved from https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/digitizing-the-consumer-decision-journey

Bouwman H, Nikou S, Molina-Castillo FJ, De Reuver M (2018) The impact of digitalisation on business models. Digital Policy, Regul Gov J 20(2):105–124

Bouyon S, Ayoub J (2018) Consumer credit, digitalisation and behavioural economics: are new protection rules needed? (No. 13831). Centre for European Policy Studies

Brodsky L, and Oakes L (2017). Data sharing and open banking. McKinsey & Company.

Brusoni S, Vaccaro A (2017) Ethics, technology and organizational innovation. J Bus Ethics 143(2):223–226. https://doi.org/10.1007/s10551-016-3061-6

Cameron A, Pham TH, Atherton J, Nguyen DH, Nguyen TP, Tran ST, Nguyen TN, Trinh HY and Hajkowicz S (2019). Vietnam’s future digital economy–towards 2030 and 2045: Brisbane: CSIRO Summary Report.

Choon YS, Chetan S (2015) An exploration into the factors driving consumers in singapore towards or away from the adoption of online shopping. Global Business Manag Res J 7(1):60–73

Court D, Elzinga D, Mulder S, and Vetvik OJ (2009). The consumer decision journey. McKinsey Quarterly.

Forest H and Rose D (2015). Delighting customers and democratising finance: digitalisation and the future of commercial banking. Deutsche Bank Global Transaction Banking.

Gray J, Addison G, Matheson E (2020) Digital banking maturity 2020. Deloitte, UK

Howard JA, Sheth JN (1989) The theory of buyer behaviour. Wilcy, New York, pp 33–34

Infocomm Media Development Authority (2019) Annual survey on infocomm usage in households and by individuals for 2019

Jain R, Alzubi J, Jain N, Joshi P (2019) Assessing risk in life insurance using ensemble learning. J Intell Fuzzy Syst 37:1–12. https://doi.org/10.3233/JIFS-190078

Johnson DS, Bardhi F, Dunn DT (2008) Understanding how technology paradoxes affect customer satisfaction with self-service technology: the role of performance ambiguity and trust in technology. Psychol Market J 25(5):416–443. https://doi.org/10.1002/mar.20218

Jun M, Palacios S (2016) Examining the key dimensions of mobile banking service quality: an exploratory study. Int J Bank Market 34(3):307–326. https://doi.org/10.1108/IJBM-01-2015-0015

Jung KC, Santhanam P, Wray P, Shubhankar S, Vandensteen J (2020) The rise of digital banking in Southeast Asia. Boston Consulting Group, Singapore

Kharpal A (2017). Amazon's Alexa stole the show at CES in a bid to become the internet of things operating system. CNBC. Retrieved from https://www.cnbc.com/2017/01/06/ces-2017-amazon-alexa-stole-the-show-a-bid-to-become-the-iot-operating-system.html. Accessed 14 December 2022.

Kollat DT, Engel JF, Blackwell RD (1970) Current problems in consumer behaviour research. J Market Res. https://doi.org/10.2307/3150290

Lemon KN, Verhoef PC (2016) Understanding customer experience throughout the customer journey. J Mark 80(6):69–96. https://doi.org/10.1509/jm.15.0420

Lindh C, Nordman E, Hanell S, Safari A, Hadjikhani A (2020) Digitalisation and international online sale: antecedents of purchase intent. J Int Consum Mark 32(4):324–335. https://doi.org/10.1080/08961530.2019.1707143

Martin KD, Murphy PE (2017) The role of data privacy in marketing. J Acad Mark Sci 45(2):135–155. https://doi.org/10.1007/s11747-016-0495-4

Maslow AH (1970) Motivation and personality, 2nd edn. Harper & Row, New York

Mbama CI, Ezepue PO (2018) Digital banking, customer experience and bank financial performance: UK customers’ perceptions. Int J Bank Market 36(2):230–255. https://doi.org/10.1108/IJBM-11-2016-0181

Moorhouse N, Tom Dieck MC, Jung T (2017) Technological innovations transforming the consumer retail experience: a review of literature. Manchester Metropolitan University, UK

Movassagh AA, Alzubi J, Gheisari M, Rahimi M, Mohan S, Abbasi A, Nabipour N (2021) Artificial neural networks training algorithm integrating invasive weed optimization with differential evolutionary model. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-020-02623-6

Ng YH, Lim SS, Ang N, Lim D, Soh G, Pakianathan P, Ang B (2021) From digital exclusion to universal digital access in Singapore. National University of Singapore, Singapore

OECD (2018) Implications of the digital transformation for the business sector, OECD conference, 8th-9th November 2018, London. OECD, France, pp 1–9

Pei SF (2018) Singapore approach to develop and regulate FinTech. Lee Kong Chian School of Business, Singapore Management University, Singapore

Periyasamy G, Rangaswamy E, Srinivasan UR (2023) A study on impact of ageing population on Singapore healthcare systems using machine learning algorithms. World Rev Entrep, Manag Sustain Dev 19(1–2):47–70. https://doi.org/10.1504/WREMSD.2023.127243

Piotrowicz W, Cuthbertson R (2016) Introduction to the special issue information technology in retail: toward omnichannel retailing. Int J Electron Commer 18(4):5–15. https://doi.org/10.2753/JEC1086-4415180400

Puccinelli NM, Goodstein RC, Grewal D, Price R, Raghubir P, Stewart D (2009) Customer experience management in retailing: understanding the buying process. J Retail 85(1):15–30. https://doi.org/10.1016/j.jretai.2008.11.003

PwC. (2016). Blurred lines: how fintech is shaping financial services. Global FinTech report. Retrieved from http://www.pwc.com/gx/en/advisory-services/FinTech/pwc-fintech-globalreport.pdf. Accessed 14 December 2022.

Ramaswamy V, Ozcan K (2018) Offerings as digitalised interactive platforms: a conceptual framework and implications. J Mark 82(4):19–31. https://doi.org/10.1509/jm.15.0365

Rangaswamy E, Nawaz N, Changzhuang Z (2022) The impact of digital technology on changing consumer behaviors with special reference to the home furnishing sector in Singapore. Humanit Soc Sci Commun 9(1):83. https://doi.org/10.1057/s41599-022-01102-x

Rangaswamy E, Nadipilli N, Nawaz N (2023) A comparative study of traditional bank A and digital bank B from an organizational innovation perspective. In: Alareeni B, Hamdan A (eds) Innovation of businesses, and digitalization during Covid-19 Pandemic. ICBT 2021. Lecture Notes in Networks and Systems, vol 488. Springer, Cham. https://doi.org/10.1007/978-3-031-08090-6_21

Reichstein C, Harting R, Neumaier P (2019) Understanding the potential value of digitization for business–quantitative research results of european experts. University of Applied Sciences, Germany

Reinartz W, Wiegand N, Imschloss M (2019) The impact of digital transformation on the retailing value chain. Int J Res Mark 36(3):350–366. https://doi.org/10.1016/j.ijresmar.2018.12.002

Riecken D (2000) Personalised views of personalisation. Commun ACM 43(8):26–28

Ryynänen TT, Hyyryläinen TT (2018) Digitalisation of consumption and digital humanities: development trajectories and challenges for the future, DHN18.

Saunders M, and Lewis P (2012). Chapter 5: choosing your research design. In Doing research in business and management (2nd ed., pp. 104–136). UK: Pearson.

Scholz J, Smith AN (2016) Augmented reality: designing immersive experiences that maximize consumer engagement. Bus Horiz 59(2):149–161

Schoonenboom J, Johnson RB (2017) How to construct a mixed methods research design. KZfSS J 69(2):107–131. https://doi.org/10.1007/s11577-017-0454-1

Singh A, Alryalat MAA, Alzubi JA, Sarma HKD (2017) Understanding Jordanian consumers’ online purchase intentions: integrating trust to the UTAUT2 framework. Int J Appl Eng Res 12(20):10258–10268

Sue H (2023). Social media statistics in Singapore [Updated 2023]. Retrieved from https://www.meltwater.com/en/blog/social-media-statistics-singapore

Sussan F, Autio E, Kosturik J (2016). Leveraging ICTs for better lives: the introduction of an index on digital life. Paper presented at CPRLATAM Conference, Mexico.

Swacha-Lech M (2017) The main challenges facing the retail banking industry in the era of digitalisation. J Insur Financ Markets Consum Prot 26(4/2017):94–116

Sweeney JC, Soutar GN (2001) Consumer perceived value: the development of a multiple item scale. J Retail 77(2):203–220. https://doi.org/10.1016/S0022-4359(01)00041-0

Taherdoost H (2016) Sampling methods in research methodology; how to choose a sampling technique for research. Int J Acad Res Manag 5:18–27. https://doi.org/10.2139/ssrn.3205035

Taisto R, and Tapani H (2018) Proceedings of the digital humanities in the nordic countries, 3rd Conference, Helsinki, Finland, 7–9th March 2018.

Taylor E (2016) Mobile payment technologies in retail: a review of potential benefits and risks. Int J Retail Distrib Manag 44(2):159–177. https://doi.org/10.1108/IJRDM-05-2015-0065

Tunn VSC, Van Den Hende EA, Bocken NMP, Schoormans JPL (2020) Digitalised product-service systems: effects on consumers’ attitudes and experiences. Resour Conserv Recycl J. https://doi.org/10.1016/j.resconrec.2020.105045

Vamos T (2009). Social, organisational, and individual impacts of automation. In Springer Handbook of Automation (pp. 71–92). Germany: Springer Science & Business Media. https://doi.org/10.1007/978-3-540-78831-7_5

Van Loo R (2017) Rise of the digital regulator. Duke Law J 66:1267–1328

Van Doorn J, Hoekstra JC (2013) Customisation of online advertising: the role of intrusiveness. Mark Lett J 24(4):339–351. https://doi.org/10.1007/s11002-012-9222-1

Verhoef PC, Stephen AT, Kannan PK, Luo X, Vibhanshu A, Andrews M, Zhang Y (2017) Consumer connectivity in a complex, technology-enabled, and mobile-oriented world with smart products. J Interact Mark 40(4):1–8. https://doi.org/10.1016/j.intmar.2017.06.001

Vives X (2019) Digital disruption in banking. Ann Rev Financ Econ 11:243–272

Wang X, Wong YD, Chen T, Yuen KF (2022) An investigation of technology-dependent shopping in the pandemic era: Integrating response efficacy and identity expressiveness into the theory of planned behavior. J Bus Res 142:1053–1067. https://doi.org/10.1016/j.jbusres.2022.01.042

Wewege L, Lee J, Thomsett M (2020) Disruptions and digital banking trends. J Appl Finance Bank 10(6):1–2

Williams C (2011) Research methods. J Bus Econ Res 5(3):65–71

Yaprak U, Kılıç F, Okumuş A (2021) Is the Covid-19 pandemic strong enough to change the online order delivery methods? Changes in the relationship between attitude and behaviour towards order delivery by drone. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2021.120829

Yarrow K (2014) Decoding the new consumer mind: how and why we shop and buy. Jossey-Bass, A Wiley Brand, San Francisco, CA

Zolkepli I, Mukhiar S, Tan CF (2020) Mobile consumer behaviour on apps usage: the effects of perceived values, rating, and cost. J Mark Commun. https://doi.org/10.1080/13527266.2020.1749108

Zott C, Amit R, Massa L (2011) The business model: recent developments and future research. J Manag 37(4):1019–1042. https://doi.org/10.1177/0149206311406265

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Contributions

Conceptualization: [ER,WS], Methodology: [ER,WS], Formal analysis and investigation: [ER,WS,GJ], Writing—original draft preparation: [ER,WS]; Writing—review and editing: [ER,WS,GJ]. Each named author has substantially contributed to conducting the underlying research and drafting this manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Human and animal rights

This article does not contain any studies with human or animal subjects performed by any of the authors.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rangaswamy, E., Yong, W.S. & Joy, G.V. The evaluation of challenges and impact of digitalisation on consumers in Singapore. Int J Syst Assur Eng Manag 15, 1704–1716 (2024). https://doi.org/10.1007/s13198-023-02023-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-023-02023-x