Abstract

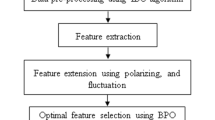

A large volume of data is constantly accumulating in contemporary information technology relating to sophisticated computing. Stock price prediction is a popular topic and a difficult task due to the randomness and complexity of stock market-related computing systems. As stock market information web content develops, researchers and investors typically extract different indicator aspects, such as attitudes and events, from stock market real-time financial data predictions. Because of the current financial and unknown aspects in the stock market arena, stock price prediction is a difficult task, even though conventional authors worked on neural networks to improve stock price prediction in several financial domains. In this research, I present a Novel Greedy Heuristic Optimized Multi-instance Quantitative (NGHOMQ) strategy to investigate needed data from factors while rejecting their parameter interactions to improve index-based composite stock market movement prediction in multi-instance quantitative data. By employing unique heuristic calculations to describe sequential stock price-related events, it may be used to blend attitudes and events as well as to analyze quantitative data in a comprehensive way. In heuristic modes with numerous instances, Pareto optimization is utilized to prevent stock price prediction based on optimal statistical performance. Furthermore, our proposed approach may detect data input to produce stock market price forecasts in financial computing technologies. The efficiency of NGHOMQ compared to traditional neural network related frameworks and approaches is demonstrated using data from the Indian stock market.

Similar content being viewed by others

References

Amores J (2013) Multiple instance classication: review, taxonomy and comparative study. Artif Intell 201:81105

Cavalcante RC, Brasileiro RC, Souza VL, Nobrega JP, Oliveira AL (2016) Computational intelligence and financial markets: a survey and future directions. Expert Syst Appl 55:194–211

Chhajer P, Shah M, Kshirsagar A (2022) The applications of artificial neural networks, support vector machines, and long–short term memory for stock market prediction. Decis Anal J 2:100015. https://doi.org/10.1016/j.dajour.2021.100015

Dietterich TG, Lathrop RH, Lozano-Pérez T (1997) Solving the multiple instance problem with axis-parallel rectangles. Artif Intell 89(12):3171

Ebrahimabadi A, Azimipour M, Bahreini A (2015) Prediction of roadheaders’ performance using artificial neural network approaches (MLP and KOSFM). J Rock Mech Geotech Eng 7:573–583. https://doi.org/10.1016/j.jrmge.2015.06.008

Feng J, Zhou Z-H (2017) Deep MIML network. In: Proceedings of 21st AAAI conference on artificial intelligence (AAAI), pp. 18841890

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Jin F, Wang W, Chakraborty P, Self N, Chen F, Ramakrishnan N (2017) Tracking multiple social media for stock market event prediction. In: Perner P (ed) Advances in data mining. Applications and theoretical aspects. Springer, London, pp 16–30

Kilic N, Ekici B, Hartomacioglu S (2015) Determination of penetration depth at high velocity impact using finite element method and artificial neural network tools. Def Technol 11:110–122. https://doi.org/10.1016/j.dt.2014.12.001

Kim JH, Shamsuddin A, Lim KP (2011) Stock return predictability and the adaptive markets hypothesis: evidence from century-long US data. J Empir Finan 18:868–879

Kotzias D, Denil M, de Freitas N, Smyth P (2015) From group to individual labels using deep features. In: Proceedings of 21st ACM SIGKDD international conference on knowledge discovery data mining (KDD), pp. 597606

Kumar G, Jain S, Singh UP (2020) Stock market forecasting using computational intelligence: a survey. Arch Comput Methods Eng. https://doi.org/10.1007/s11831-020-09413-5

Kumar DA, Murugan S (2013) Performance analysis of Indian stock market index using neural network time series model. In: Proceedings of the international conference on pattern recognition, informatics and mobile engineering, Salem, India, 21–22. pp. 72–78

Liu G, Wu J, Zhou Z-H (2012) Key instance detection in multiinstance learning. In: Proceedings of Asian conference on machine learning, pp. 253268

Luo L, You S, Xu Y, Peng H (2017) Improving the integration of piece wise linear representation and weighted support vector machine for stock trading signal prediction. Appl Soft Comput 56:199–216

Ma F, Chitta R, Zhou J, You Q, Sun T, Gao J (2017) Dipole: diagnosis prediction in healthcare via attention-based bidirectional recurrent neural networks. In: Proceedings of the 23rd ACM SIGKDD international conference on knowledge discovery and data mining, KDD '17. ACM, pp. 1903–1911

Nau R (2014) Mathematical structure of ARIMA models, vol 1, pp 1–8

Ning Y, Muthiah S, Rangwala H, Ramakrishnan N (2016) Modeling precursors for event forecasting via nested multi-instance learning. In: Proceedings of 22nd ACM SIGKDD international conference on knowledge discovery data mining (KDD), pp. 10951104

Polamuri SR, Srinivas K, Mohan AK (2019) Stock market prices prediction using random forest and extra tree regression. Int J Recent Tech Eng 8(3):1224–1228

Polamuri SR, Srinivas K, Mohan AK (2020) Multi model-based hybrid prediction algorithm (MM-HPA) for stock market prices prediction framework (SMPPF). Arab J Sci Eng. https://doi.org/10.1007/s13369-020-04782-2

Polamuri SR, Srinivas K, Mohan AK (2021) Multi-model generative adversarial network hybrid prediction algorithm (MMGAN-HPA) for stock market prices prediction. J King Saud Univ Comput Inf Sci. https://doi.org/10.1016/j.jksuci.2021.07.001

Qiu J, Wang B, Zhou C (2020) Forecasting stock prices with long-short term memory neural network based on attention mechanism. PLoS ONE 15(1):e0227222. https://doi.org/10.1371/journal.pone.0227222

Rao JNK, Box GEP, Jenkins GM (1972) Time series analysis forecasting and control. Econometrica 40:970

Rao PS, Srinivas K, Mohan AK (2020) A survey on stock market prediction using machine learning techniques. In: Kumar A, Paprzycki M, Gunjan V (eds) ICDSMLA 2019. Lecture notes in electrical engineering, vol 601. Springer, Singapore. https://doi.org/10.1007/978-981-15-1420-3_101

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

All authors listed have made a substantial, direct and intellectual contribution to the work, and approved it for publication.

Corresponding author

Ethics declarations

Conflict of interest

All Authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

This article was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Polamuri, S.R., Srinnivas, K. & Mohan, A.K. Prediction of stock price growth for novel greedy heuristic optimized multi-instances quantitative (NGHOMQ). Int J Syst Assur Eng Manag 14, 353–366 (2023). https://doi.org/10.1007/s13198-022-01801-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-022-01801-3