Abstract

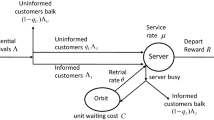

The authors consider an M/M/1 queue with two types of customers, where customers are classified into two categories according to their psychological feelings when facing uncertainty about queue information. In the unobservable queue, experienced customers could accurately calculate their expected utilities, while first-time customers are loss-averse and the psychological feelings could incur additional gain-loss utilities. By defining customers’ willingness to pay, the authors derive the equilibrium joining-balking behaviors for each type of customer and obtain the service provider’s optimal pricing decision. The authors also classify the implications of the obtained results.

Similar content being viewed by others

References

Jiang B and Yang B, Quality and pricing decisions in a market with consumer information sharing, Management Sci., 2018, 65(1): 272–285.

Kœszegi B and Rabin M, A model of reference-dependent preferences, Quart. J. Econom., 2006, 121(4): 1133–1165.

Abdellaoui M and Kemel E, Eliciting prospect theory when consequences are measured in time units: Time is not money, Management Sci., 2014, 60(7): 1844–1859.

Tereyağoğlu N, Fader P, and Veeraraghavan S, Multi-attribute loss aversion and reference dependence: Evidence from the performing arts industry, Management Sci., 2018, 64(1): 421–436.

Zhou W, Wang D, Huang W, et al., To pool or not to pool? The effect of loss aversion on queue confgurations, Prod. Oper. Manag., 2021, 30(11): 4258–4272.

Ni G, Xu Y, and Dong Y, Price and speed decisions in customer-intensive services with two classes of customers, Eur. J. Oper. Res., 2013, 228(2): 427–436.

Zhou W, Chao X, and Gong X, Optimal uniform pricing strategy of a service firm when facing two classes of customers, Prod. Oper. Manag., 2014, 23(4): 676–688.

Zhou W, Lian Z, and Wu J, When should service firms provide free experience service? Eur. J. Oper. Res., 2014, 234: 830–838.

Tang Y, Guo P, and Wang Y, Equilibrium queueing strategies of two types of customers in a two-server queue, Oper. Res. Lett., 2018, 46: 99–102.

Hu M, Li Y, and Wang J, Efficient ignorance: Information heterogeneity in a queue, Management Sci., 2018, 64(6): 2650–2671.

Wang Z and Wang J, Information heterogeneity in a retrial queue: Throughput and social welfare maximization, Queueing Syst., 2019, 92: 131–172.

Huang F, Guo P, and Wang Y, Cyclic pricing when customers queue with rating information, Prod. Oper. Manag., 2019, 28(10): 2471–2485.

Wang J and Sun K, Optimal pricing and capacity sizing for online service systems with free trials, OR Spectrum, 2022, 44: 57–86.

Ibrahim R, Sharing delay information in service systems: A literature survey, Queueing Syst., 2018, 89(1): 49–79.

Economou A, The impact of information structure on strategic behavior in queueing systems, Queueing Theory 2: Advanced Trends, Eds. by Anisimov V and Limnios N, Wiley/ISTE, New York, 2021.

Wang Z and Fang L, The effect of customer awareness on priority queues, Nav. Res. Log., 2022, 69(5): 801–805.

Kahneman D and Tversky A, Prospect theory: An analysis of decision under risk, Econometrica, 1979, 47(2): 263–291.

Gill D and Prowse V, A structural analysis of disappointment aversion in a real effort competition, Amer. Econom. Rev., 2012, 102(1): 469–503.

Karle H, Kirchsteiger G, and Peitz M, Loss aversion and consumption choice: Theory and experimental evidence, Amer. Econom. J.: Microeconom, 2015, 7(2): 101–120.

Nasiry J and Popescu I, Dynamic pricing with loss-averse consumers and peak-end anchoring, Oper. Res., 2011, 59(6): 1361–1368.

Chen X, Hu P, Shum S, et al., Dynamic stochastic inventory management with reference price efects, Oper. Res., 2016, 64(6): 1529–1536.

Zhang J and Li K J, Quality disclosure under consumer loss aversion, Management Sci., 2021, 67(8): 5052–5069.

Yang L, Guo P, and Wang Y, Service pricing with loss-averse customers, Oper. Res., 2018, 66(3): 761–777.

Jiang T, Chai X, Liu L, et al., Optimal pricing and service capacity management for a matching queue problem with loss-averse customers, Optimization, 2021, 70(10): 2169–2192.

Ülkü S, Hydock C, and Cui S, Making the wait worthwhile: Experiments on the effect of queueing on consumption, Management Sci., 2020, 66(3): 1149–1171.

Buell R W, Last-place aversion in queues, Management Sci., 2021, 67(3): 1329–1992.

Wang Z, Yang L, Cui S, et al., Pooling agents for customer-intensive services, Oper. Res., 2022, 71(3): 860–875.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors declare no conflict of interest.

Additional information

This research was supported by the National Natural Science Foundation of China under Grant No. 12001329, Shandong Provincial Natural Science Foundation under Grant No. ZR2019BG014, Scientific Research Foundation of Anhui Polytechnic University under Grant No. 2022YQQ026, Scientific Research Foundation of Shandong University of Science and Technology for Recruited Talents under Grant No. 2019RCJJ016.

Rights and permissions

About this article

Cite this article

Jiang, T., Gao, L., Chai, X. et al. Psychological Heterogeneity in a Queue: The Impact of Loss Aversion on Service Pricing. J Syst Sci Complex 36, 2536–2558 (2023). https://doi.org/10.1007/s11424-023-2117-9

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-023-2117-9