AzeriCard

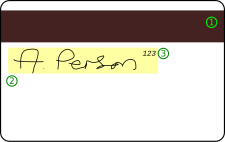

Appearance

| Industry | Financial services |

|---|---|

| Founded | 1996 in Baku, Azerbaijan |

| Headquarters | |

| Services | card processing |

| Parent | International Bank of Azerbaijan |

AzeriCard is an Azerbaijani bank card processing company.[1] The International Bank of Azerbaijan owns 100 percent of AzeriCard.[2]

Products

[edit]Mobile Wallet

[edit]- AzeriCard offers customers what is known as a “mobile wallet." Customers can use their smartphone to pull out cash from ATMs without using an actual bank card during the transaction. The technology is named “Way4 Cash By Code."[3]

- AzeriCard worked with technology company OpenWay to produce the mobile wallet service.[3]

- By 2011, 15 banks in Azerbaijan were using mobile banking technology provided by AzeriCard.[4]

Market share

[edit]- As of 2016 November-end, 35% of plastic cards, 65% of ATMs and 62% of point-of-sale terminals in Azerbaijan are served by AzeriCard.[5]

- Currently, more than twenty banks locally and internationally use the services of AzeriCard.

Competitors

[edit]As of the beginning of 2017, there are two other companies in addition to AzeriCard that provide card processing services: MilliKart and KapitalBank.[6]

History

[edit]

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name

First bank card

[edit]- In 1997 AzeriCard was credited with creating the very first bank card in the country of Azerbaijan; the card was issued by the International Bank of Azerbaijan.[7]

- AzeriCard’s systems work with MasterCard, Visa, American Express, Diners Club, UnionPay and JCB International.

Ownership

[edit]- AzeriCard is one of several subsidiaries of the International Bank of Azerbaijan. Other subsidiaries are:.[8]

- IBA-Moscow

- International Bank of Azerbaijan-Georgia

- International Insurance Company

- In addition to the International Bank of Azerbaijan, AzeriCard works directly with IBA-Moscow and IBA-Georgia.[2]

Customers

[edit]Banks that use AzeriCard’s services are:[1]

- AGBank

- Amrahbank

- AtaBank

- Bank Respublika

- International Bank of Azerbaijan

- PASHA Bank

- Nikoil Bank

- Ziraat Bank Azerbaijan

- Silk Way Bank

- TuranBank

- Xalq Bank

- AFB Bank

- Azer-Turk Bank

- Bank Avrasiya

- Bank BTB

- NBC Bank

- Caspian Development Bank

- MuganBank

- Rabitabank

- VTB Bank Azerbaijan

- KDB Bank Uzbekistan

See also

[edit]References

[edit]- ^ a b “AzeriCard and OpenWay bring cardless ATM withdrawals to Azerbaijan", Finextra Research website, Printed August 9, 2013 (Retrieved August 20, 2013)

- ^ a b J. Nasibova, “Level of non-cash payments use increases in Azerbaijan", Trend News Agency, November 20, 2012 (Retrieved via Nexis on August 20, 2013)

- ^ a b Elliott Holley, “Azerbaijan mobile wallet makes debut" Archived 2016-03-02 at the Wayback Machine, Banking Technology, August 8, 2013 (Retrieved August 20, 2013)

- ^ N. Ismayilova, “Azerbaijani processing centre to introduce new version of mobile banking", Trend Daily Economic News, November 20, 2012 (Retrieved via Nexis on August 20, 2013)

- ^ H. Valiyev, “BRIEF: Azericard introduces cash transfer service to cards using ATMs," Trend News Agency, December 10, 2012 (Retrieved via Nexis on August 20, 2013)

- ^ A. Hasanov, “Non-cash payments in Azerbaijan to create a breakthrough in card market", Trend Daily Economic News, February 29, 2012 (Retrieved via Nexis on August 20, 2013)

- ^ "First Bank Card in Azerbaijan Marks 15 Years from Date of Issue", Economic News (Information Agency Oreanda), November 14, 2012 (Retrieved via Nexis on August 20, 2013)

- ^ “Audit of MBA trusted to Deloitte & Touche", Turan Information Agency, August 14, 2013 (Retrieved via Nexis on August 20, 2013)