iBet uBet web content aggregator. Adding the entire web to your favor.

Link to original content: http://treasurer.delaware.gov/education-savings-plan/

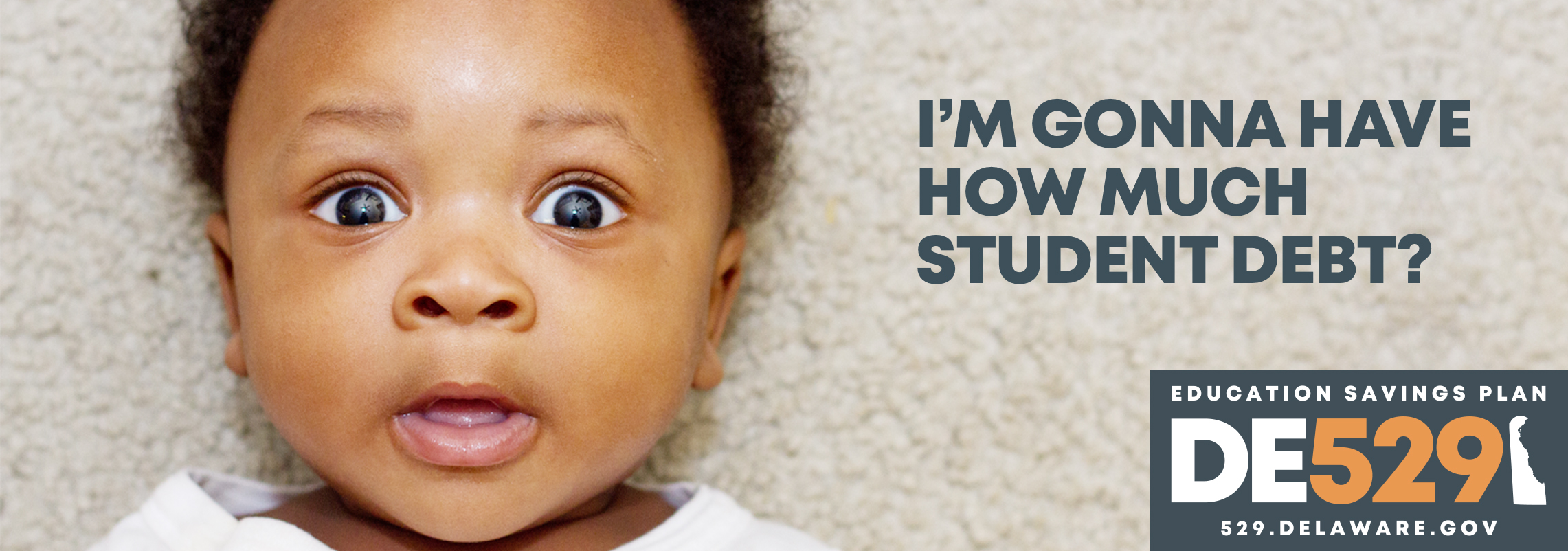

Delaware’s 529 Plan is sponsored by the State of Delaware and managed by Fidelity Investments. The Plan provides tax-advantaged accounts designed to help parents, grandparents and others pay for higher education expenses. Contributions can be invested in portfolios tailored to a child’s age or the investor’s ability to identify an asset allocation strategy. Withdrawals can be used for qualified expenses at any accredited college nationwide and many international institutions.

“First State, First Steps” is an incentive program for Delawareans offering a $100 contribution to a new DE529 Education Savings Plan account opened through December 31, 2024.

In addition to the account being opened during the applicable time period, in order to qualify for the $100 incentive:

Additional information can be found here.

Tax advantages

You won’t pay any taxes on your money as it grows. Plus, withdrawals for qualified higher education

expenses like tuition, fees, and books are federal and Delaware income tax-free.

Federal adjusted gross income will be reduced for any contribution up to $1,000 (or $2,000 for joint returns) with a few conditions.

The deduction will NOT apply to:

Deductions for couples with an AGI below $200,000 are capped at $2,000.

Flexible options for your savings

You are not limited to in-state schools. You can use the funds at almost all accredited colleges and

universities nationwide, many vocational or technical schools, and eligible foreign institutions — for

a wide range of qualified higher education expenses.

A range of investment choices

You can leave the investment decisions to Fidelity by selecting an Age-Based Strategy that invests your

savings in a Portfolio based on the beneficiary’s age. Or, if you prefer, you can select a Custom Strategy

by choosing your own Portfolio(s).

It’s easy to get started

With $50 or as little as $15 a month, you can put your Delaware College Investment Plan account

into action. Contributions can be made automatically from your bank account, from your Fidelity

Account®, or with direct deposit from your paycheck (if offered through your employer). Delaware

taxpayers can direct their tax refunds to their 529 college investment savings plan when completing

their state income tax return.

Related Topics: 529, Colleen C. Davis, college savings, education savings, office of the state treasurer, state treasurer