Banking industry in the United States - statistics & facts

The banking industry in the U.S. is dominated by four giants: JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. These institutions not only lead domestically but also rank among the largest banks worldwide, with JPMorgan Chase holding the title of the largest bank by market capitalization. Almost all banks in the country are insured by the Federal Deposit Insurance Corporation (FDIC), providing a safety net for deposits up to 250,000 U.S. dollars. Despite this security, the number of FDIC-insured commercial banks has been steadily declining since 2000.

Recent performance indicators

The recent performance of the banking sector reflects a period of adjustment and resilience. Asset growth of the U.S. banking industry, which saw a drastic drop in 2022, began a gradual incline in 2023, signaling a recovery. Return on equity (ROE) took a dip towards the end of 2023 but stabilized in the first quarter of 2024, indicating renewed investor confidence. While the net income of U.S. commercial banks has decreased in recent years, it has remained relatively high, showcasing the industry's ability to adapt and maintain profitability despite economic challenges. Amid these financial dynamics, a significant shift is also evident in the adoption of online banking services, which raises the question: will traditional banks be able to keep up with digital banks?Traditional vs online banking

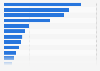

The increasing adoption of online banking has transformed the U.S. banking landscape. More and more bank executives view challenger banks as a significant threat to traditional banking institutions. Their concerns are not baseless, as the most popular digital banks in the U.S. have garnered over 10 million users each, highlighting their rapid growth and appeal. However, the leading traditional banks still top these figures, maintaining their dominant position in the market. The four largest banks’ digital user base increased rapidly in recent years. In 2023, JPMorgan Chase had over 50 million active mobile banking customers, while Bank of America had close to 40 million.The U.S. banking industry bounced back quickly after the challenging conditions of early 2023, with key performance indicators stabilizing. Traditional banks continue to lead the market, but the rise of digital banks with significant user bases signals a growing shift towards online banking. As digital adoption increases, traditional banks must innovate to stay ahead in this evolving landscape.