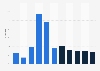

CPI inflation rate in the UK 2024, by sector

In October 2024, the UK inflation rate was 2.3 percent, with prices rising fastest in the health sector, which had an inflation rate of 5.6 percent. In this month, prices were rising in most sectors, except for the furniture and transport sectors. The inflation rate for services as a whole was five percent, while for goods, prices fell by 0.3 percent.

UK inflation set to remain high in 2024

After reaching a peak of 11.1 percent in October 2022, the CPI inflation rate in the UK gradually declined throughout 2023, and had fallen to four percent by the end of the year. Although this was a significant decline from the previous year, it is still higher than the Bank of England's usual target of two percent. Going into 2024, recent forecasts suggest that over the course of that year, inflation will average out at 3.6 percent, with the two percent target not met until at least 2025 when the annual inflation rate is predicted to be 1.8 percent.

Roots of the inflation crisis

This long period of high inflation that the UK and much of the world is currently experiencing has its roots in the post-pandemic economic recovery of 2021. During that year, as consumer demand returned, global supply chains struggled to return to full capacity, resulting in prices rising. With inflation already high going into 2022, Russia's invasion of Ukraine added even more inflationary pressures to the global economy. European markets which were heavily reliant on Russian oil and gas have gradually phased out hydrocarbons from this market. Food prices were also heavily impacted due to Ukraine's difficulty in exporting its agricultural products.