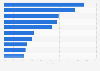

Tier 1 capital ratio at Deutsche Bank 2009-2023

Deutsche Bank’s tier 1 capital ratio increased to 16.1 percent in 2023 from 15.7 percent the year before. 2023 was the fifth consecutive year with increasing tier 1 capital ratio at the German bank. The ratio reported in 2022 was even higher than at JPMorgan Chase, one of the largest U.S. banks.

What is tier 1 capital?

Tier 1 capital is money that a bank must keep on hand, here expressed as a percentage of overall assets. This ratio is important because banks do not hold their total assets in their vault. Instead, they issue loans for which they can charge interest. The capital that they keep on hand is a buffer to ensure that they can cover any demands for withdrawals.

Preventing a bank run

If a large share of depositors request money at the same time, the bank may have trouble repaying them all immediately. This is called a bank run and can lead to bank failures, like those in 1930 and 1931. Fortunately, Deutsche Bank can rely on the European Central Bank’s marginal lending facility for overnight loans in case of a run on deposits. However, with a robust tier 1 capital ratio, the need for overnight loans should be minimal.