Retail real estate market in the United States - statistics & facts

The retail real estate sector shows resilience

Economic uncertainty and higher interest rates have proven challenging for the commercial real estate sector, but retail displays overall stable fundamentals. In 2023, retail had an average vacancy rate as low as four percent. The vacancy rate for general retail properties was even lower, indicating that this property type has the most demand relative to the existing supply. General retail is the most common type of retail space and refers to single-tenant, freestanding, general-purpose buildings with parking. The share of vacant space in such properties was about three times lower than in malls and two times lower than in neighborhood centers. Another reason for the positive sentiment among investors is that the average rent for shopping centers, including power, regional, neighborhood, community, and strip centers, has grown steadily across all U.S. regions since 2020. That is also reflected in the development of retail property prices, which have shown higher resilience than other asset classes such as offices, industrial, or multifamily.Who are the market leaders in the retail real estate market?

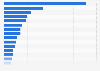

Simon Property Group and Realty Income Corporation are the U.S. retail real estate investment trusts (REITs) with the largest market cap. The two companies boasted a market cap of over 40 billion U.S. dollars each as of December 2023. Simon Property Group’s portfolio includes some of the biggest malls in the country. King of Prussia in Philadelphia, Del Amo Fashion Center in Los Angeles, and Roosevelt Field in New York were just a few of the malls owned by Simon Property Group. Nevertheless, when considering the five-year return of the 20 largest retail REITs by market cap, the two smaller companies, Essential Properties Realty Trust and Inventrust Properties, displayed the highest returns.The recovering economy and consumer confidence provide favorable conditions for the growth of the retail real estate sector. Nevertheless, to continue to grow, the sector must overcome the current supply constraint.