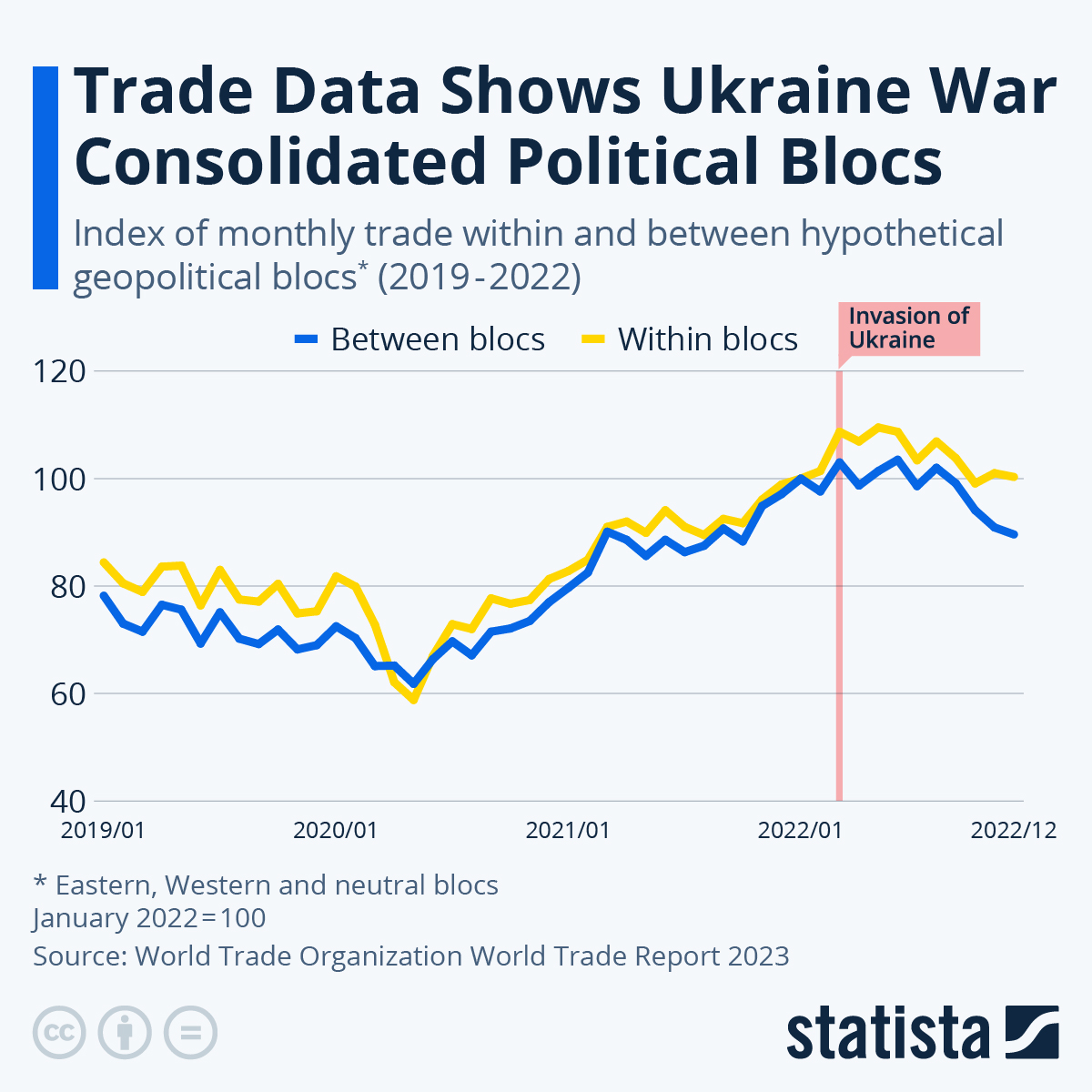

The divisive effect of the Ukraine war has become visible in trade data as geopolitical blocs have conducted significantly less business with one another since early 2022. A release by the World Trade Organization shows that both trade between as well as trade within blocs has suffered as sanctions and blockades in the aftermath of the Russian invasion have stood in the way of trade flows.

Taking January 2022 as a starting point for an index calculation, the World Trade Report 2023 reveals that global trade between geopolitical blocs, for example between Western bloc countries in the Americas and Europe and Eastern bloc countries like China, Russia and Saudi Arabia, has decreased by more than 10 percent between the start and the end of last year alone. Trade within blocs stood at almost 109 index points around the time of the invasion in late February of 2022 and was down again to 100 points as of December.

Western bloc countries shunning Russian oil since the beginning of the Ukraine war surely contributed to the effect. As the commodity rose in price, India and China increased their purchases while Russia was eager to offload its sanction-related surplus stockpiles, shifting global trade patterns in the process. According to the report, U.S.-China trade tensions had even earlier started to change these patterns as the United States sought to increase trade with other partners.

Diversification is one argument for near-shoring or, even more fitting in this sense, friend-shoring, which describes sourcing from and trading with countries thought to belong to the same geopolitical entity. According to WTO authors, concentrated global production - potentially outside of some countries' geopolitical blocs - holds inherent risks in crisis situations despite having the advantage of all economies of scale, namely lower prices. While diversification of sourcing can be viewed positively given current global upheavals and has worked to fill trade gaps, a progressing bloc mindset is sure to hurt trade and global economic progress in the long term. Another report by the WTO from earlier this year warns of the costs associated with a departure from multilateral trade. It puts this cost at 8.7 percent of real income at the global level and as high as 11.3 percent in least-developed countries.