eCommerce: Europe

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Which stores lead Europe’s top 20, and how do their sales and market shares show their strength in meeting varied consumer needs? Discover insights ahead.

Article by Cihan Uzunoglu | October 28, 2024

Top 20 Online Stores in Europe: Key Insights

Amazon’s Lead: Amazon’s German and UK stores rank at the top of Europe’s 20 leading online retailers, commanding a large share of net sales and underscoring their pivotal role in European eCommerce.

Global Presence: Europe’s top 20 online stores include companies from the U.S., UK, Sweden, Germany, Turkey, and China. This reflects a broad international footprint in the region’s online retail.

Competitive Sector: While Amazon holds a prominent position, various retailers also capture noteworthy shares, hinting at strong competition and potential growth. Numerous European marketplaces contribute further by creating distinct growth opportunities.

Europe’s online retail market is dynamic and diverse, featuring major players like IKEA, Shein, and Apple. But which company claims the top spot in eCommerce net sales?

Amazon’s German and UK sites take the top two positions, but strong competition persists among other major eCommerce brands across Europe.

Top Online Stores in Europe:

Amazon Stores Lead

As one of the largest regions in terms of eCommerce net sales, Europe is home to many big names in online shopping.

Among the top online stores in Europe, we see familiar faces:

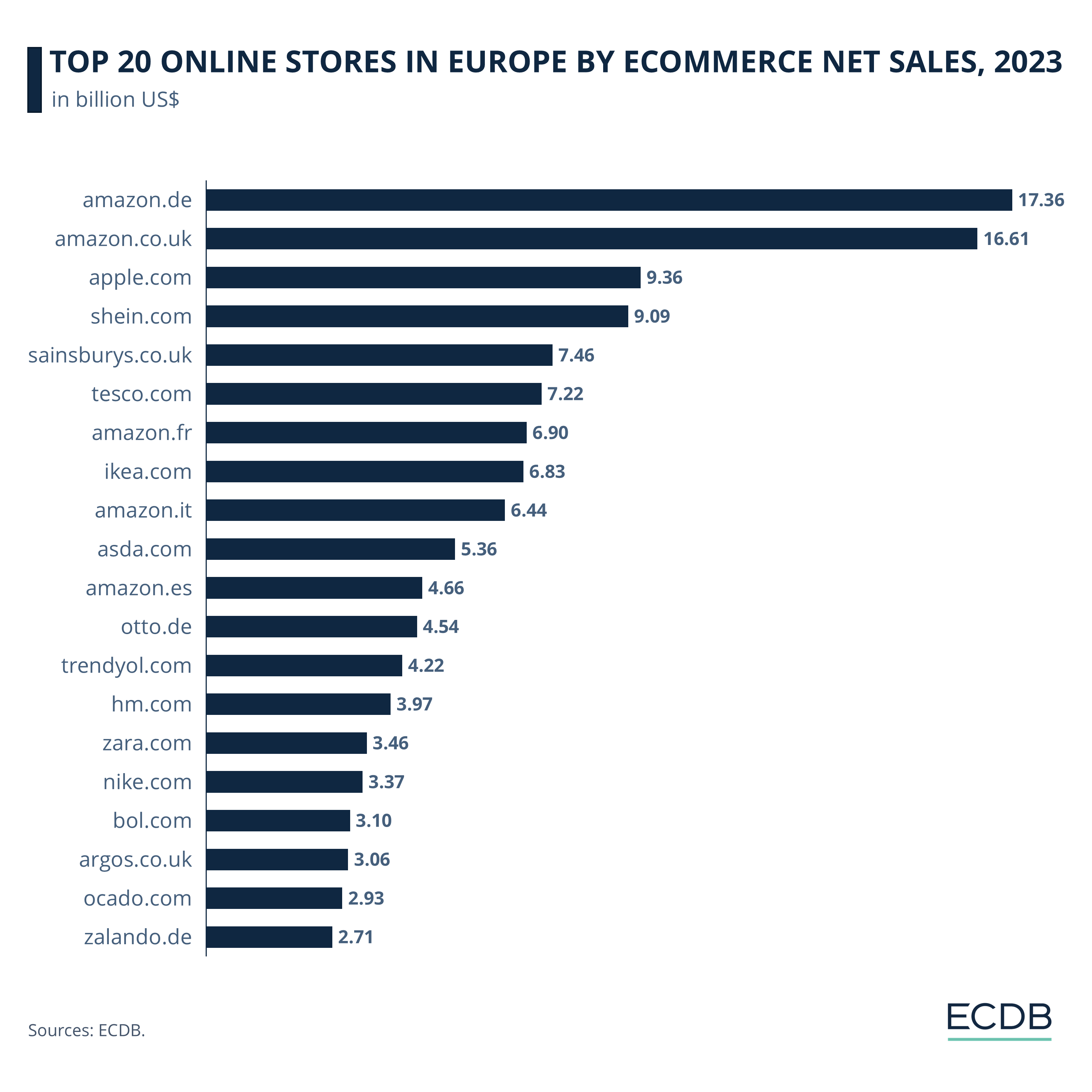

Amazon's German and UK domains take the top 2 spots with 2023 net revenues of US$17.36 and US$16.61 billion, respectively.

Apple.com and shein.com follow with net revenues of US$9.36 billion and US$9.09 billion, respectively.

Sainsbury.co.uk, tesco.com, amazon.fr, Ikea.com, amazon.it, and asda.com make up the middle tier of the ranking.

With net sales of US$2.7 billion to US$4.6 billion each, amazon.es, otto.de, trendyol.com, hm.com, zara.com, nike.com, bol.com, argos.co.uk, ocado.com and zalando.de round out the list.

European Online Stores: Top 5 eCommerce Stores in the Ranking

Understanding the European online shopping market requires a deep dive into the performance of its main competitors. Here’s a detailed analysis of the top 5 online stores and their individual market shares.

1. Amazon

Among the top 20 online stores in Europe, amazon.de comes on top with net sales of US$17.36 billion in 2023. The online store captures a significant 14.3% share in the top 20 online stores in Europe, while holding an impressive 10.1% share in the larger scope of the top 50 online stores.

Close behind is amazon.co.uk, with net sales of US$16.61 billion and a 12.7% share in the top 20, accounting for 9% of the top 50 market in Europe. Along with three other stores (.es, .fr, .it) on the list, Amazon stores in Europe's top 20 online shops account for nearly 40% of net sales.

2. Apple

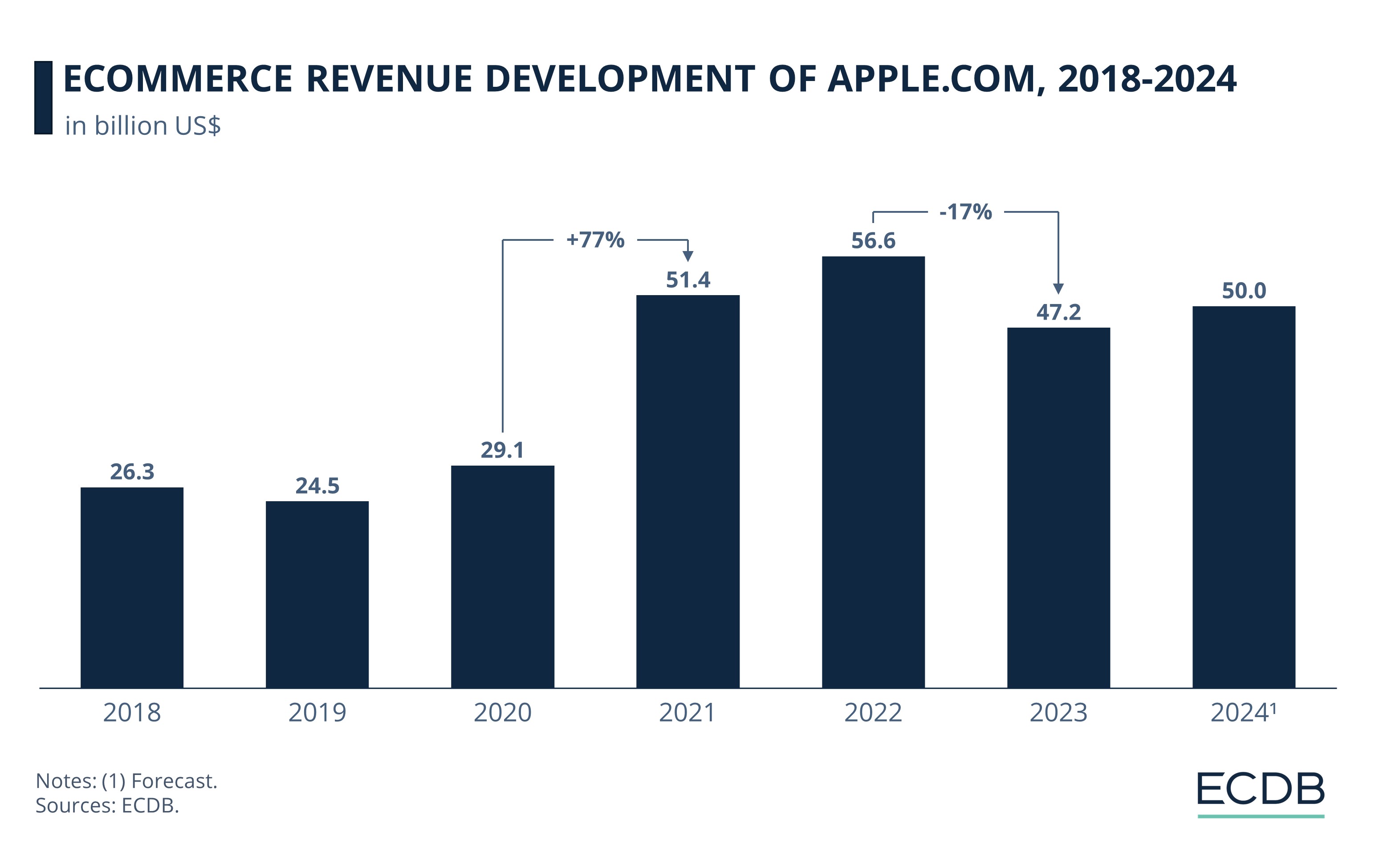

The third position is occupied by apple.com with US$9.36 billion, representing a 7.1% share in the top 20 and 5.2% share in the top 50.

Apple's recent unveiling of the Vision Pro AR headset has a big potential in changing eCommerce by enhancing immersive shopping experiences through intuitive interaction methods. Additionally, iPhones continue to drive significant online sales, greatly influencing eCommerce trends.

The brand's strong reputation, valued at US$880.5 billion last year, underpins its market success. As Apple integrates advanced technology and maintains high consumer trust, it sets benchmarks in both innovation and brand value, solidifying its position in the global eCommerce scene.

3. Shein

Shein.com ranks fourth with US$9.09 billion in net sales. Forecast to reach US$48 billion worldwide by 2024, Shein has seen explosive growth, jumping from US$2.5 billion in 2019 to US$13.6 billion in 2021.

The company's success stems from its efficient large-scale automated test and re-order model, which rapidly introduces new styles, and a robust influencer marketing strategy. This approach resonates particularly well with Gen Z and Gen Y consumers, making Shein a dominant force in the fast fashion industry.

4. Sainsbury

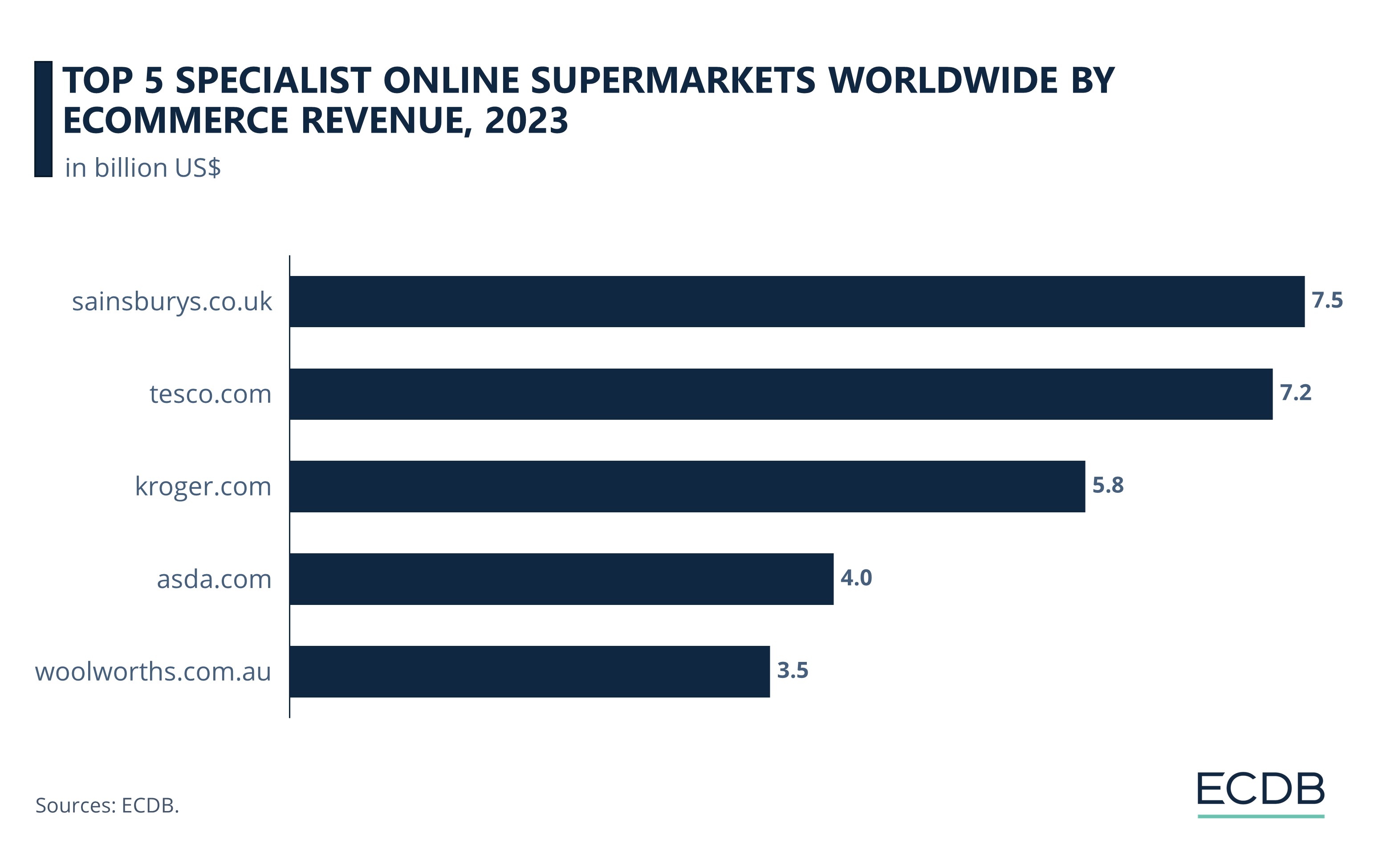

Sainsburys.co.uk follows with net sales of US$7.46 billion, maintaining a 5% share in the top 20 and 4.1% in the top 50.

As of 2023, the online store is the leading online supermarket worldwide, ahead of tesco.com. Despite a 5.4% decline in 2022, Sainsbury's dominance highlights its strong presence in the competitive UK online grocery market. The store focuses heavily on the grocery category, contributing to 58% of its sales.

5. Tesco

Tesco.com follows closely behind Sainsbury's with net sales of US$7.22 billion.

As the second largest eCommerce grocery store worldwide, Tesco.com achieved an impressive 11.6% year-on-year growth in 2023. Tesco is maintaining its strong position as a leader in the UK online grocery market.

Tesco generates most of its net sales from the Grocery category (65%), with Fashion (14%) being its second biggest segment. Additional contributions come from Personal Care (10%), Furniture & Homeware (8%), and Hobby & Leisure (3%). Tesco's dominance in grocery eCommerce is highlighted by its revenue of US$4.2 billion in 2023, surpassing Sainsbury's, which recorded US$3.8 billion in the same category.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Europe Online Shopping: Market Analysis

When examining the top 20 online stores in Europe, it becomes evident that the market is predominantly influenced by companies hailing from a select number of countries.

American technology giants have a strong foothold, notably with Amazon variants (.de, .uk, .es, .fr, .it) and Apple making the list. They are accompanied by Nike, another U.S. based retail giant.

United Kingdom firms also maintain a strong presence, with supermarkets Sainsbury's, Tesco, and Asda, as well as Argos, Ocado, and ASOS representing the retail diversity of the country.

Sweden contributes with IKEA and H&M, both of which have broad international reach.

In addition, Otto from Germany, Trendyol from Turkey, and Shein from China round out the list, each representing the eCommerce strength of their respective countries.

This mix reflects not only regional powerhouses but also the global scope of online retail in Europe.

The Return of eCommerce Growth & Heightened Competition

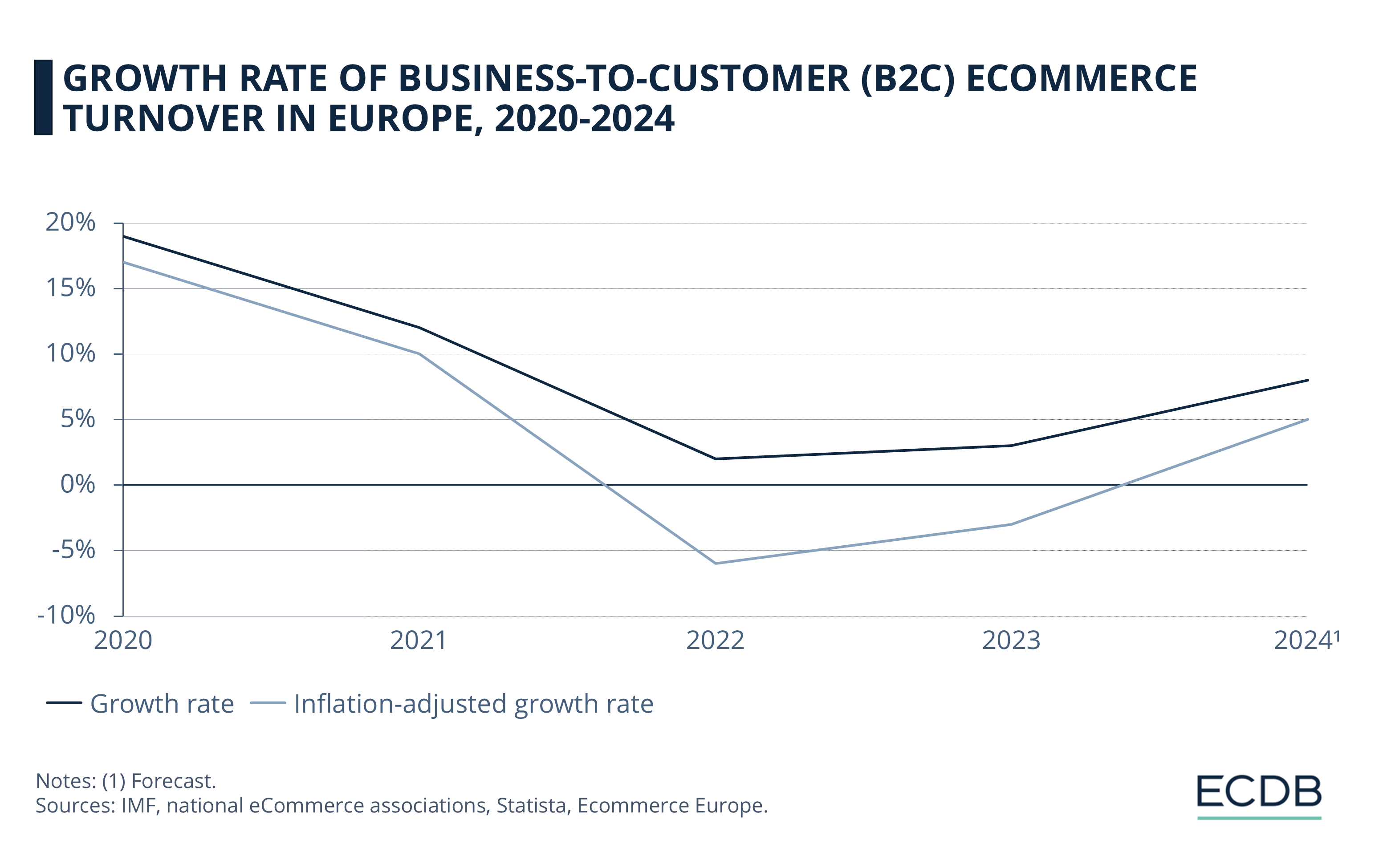

In 2024, eCommerce in Europe is set to grow by 8%, reaching €958 billion (roughly US$1.04 billion), according to a report by Ecommerce Europe. This resurgence marks the first year since 2021 that growth has surpassed inflation, signaling a recovery in consumer confidence.

The path to recovery has seen varied growth trends in recent years:

During the pandemic in 2020, Europe’s B2C eCommerce turnover peaked at a 19% growth rate (17% inflation-adjusted), but this momentum slowed significantly in 2022 with just a 2% growth rate and a -6% contraction once adjusted for inflation.

This year’s forecasted 8% growth (5% inflation-adjusted) reflects the strongest real growth since 2021, highlighting a renewed demand for affordability despite ongoing inflation pressures.

Consumers are increasingly returning to online shopping, though many are opting for cheaper products, often from low-cost platforms like Temu. Temu has significantly increased competition in Europe’s online retail space by offering extremely low-priced products. Platforms like Temu have seen strong growth, especially among price-conscious consumers in countries like Germany and Denmark, where Chinese goods have become more popular. Local eCommerce leaders argue that Chinese marketplaces benefit from operating under less stringent regulations, creating challenges for European retailers.

Temu has significantly increased competition in Europe’s online retail space by offering extremely low-priced products. Platforms like Temu have seen strong growth, especially among price-conscious consumers in countries like Germany and Denmark, where Chinese goods have become more popular. Local eCommerce leaders argue that Chinese marketplaces benefit from operating under less stringent regulations, creating challenges for European retailers.

Amazon Market Share in Europe

Amazon's dominance in European eCommerce is unmistakable. In 2023, Amazon's GMV in Europe was 60% higher than the combined sales of the top 10 online marketplaces.

Amazon's European markets account for 24% of its global sellers, with the UK and Germany being the largest markets. These two countries contribute 8.4% and 7.7% of Amazon's total GMV, respectively.

In 2022, Amazon commanded 54% of the European digital retail media market, generating US$3.4 billion — almost 6.5 times more than eBay. Additionally, Amazon's lobbying expenses in the EU increased from half a million dollars in 2013 to US$4.5 million in 2023, highlighting its regulatory influence.

Biggest Winners of 2023

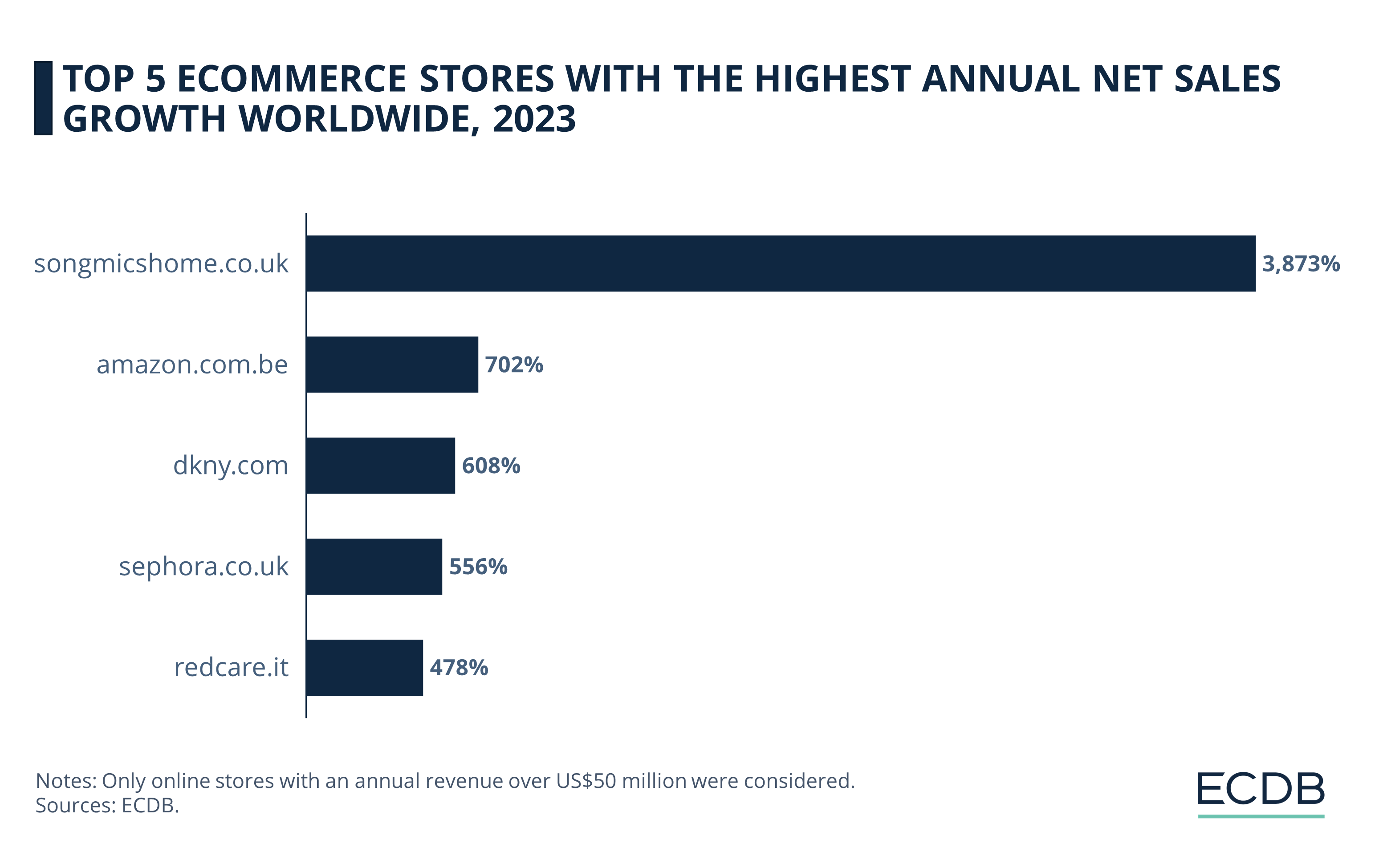

Among the top 5 fastest-growing eCommerce stores, we see that many are European domains:

The UK store of the Chinese Furniture & Homeware retailer Songmicshome ranks first, with an annual growth rate of 3,873% in 2023.

Amazon's Belgium store is in second place, with a year-on-year growth rate of 702%. This means that it grew approximately 8 times its 2022 value in one year.

While DKNY.com at #3 (608% growth) is an American online store, sephora.co.uk at #4 originates from the UK (556% growth).

The Italian online pharmacy redcare.it rounds out the list with an annual growth rate of 478%.

Sources: Nethansa, Statista, Reuters, ECDB

FAQ: Top Online Stores in Europe

What is the best online shop in Europe?

Amazon, Apple, Shein, IKEA and Sainsbury's lead the European market in terms of net sales. Tesco, Wildberries, Otto, H&M and Argos are other popular online shops.

Who is the biggest online retailer in Europe?

Amazon is the biggest online retailer in Europe.

What is the European equivalent of Amazon?

Wildberries, Zalando, Ozon, Allegro, Vinted, Trendyol and Otto are popular marketplaces in Europe, though none of them reach Amazon's scale.

What is the largest marketplace in Europe?

Amazon is the top online marketplace in Europe with a GMV (Gross Merchandise Volume) of US$201 billion in 2023.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics