eCommerce: Marketplaces

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto is a major name in German retail, but the company is facing several issues. New competition, declining revenue, and a recent crisis, including the loss of over 1,000 sellers, high fees, and technical problems, are taking a toll. How can Otto remain competitive in eCommerce?

Article by Nadine Koutsou-Wehling | September 24, 2024

Otto Group eCommerce: Key Insights

Otto's eCommerce subsidiaries: The German retail conglomerate Otto GmbH & Co. KG launched the fashion platform About You as a subsidiary, which is now an associated company. Another major German fashion store with ties to Otto is Bonprix. But there is a long list of other subsidiaries in various industry fields, such as Crate & Barrel, Baur, Frankonia, Lascana, Limango, and others.

Otto Group's Sales Growth Lags Global Rates: After 2020, none of the Otto Group's annual revenue growth rates reached the global average. It also lags behind global household names such as Amazon or Temu.

Issues to Address in the Future: Otto Group's main problems are a lack of differentiation from market leaders, international irrelevance, and an outdated focus on subsidiaries. We conclude with possible steps to improve its position.

Challenges Otto Faces: Otto lost over 1,000 sellers due to high fees, dissatisfaction, and technical issues, requiring improvements to recover.

Otto is one of Germany’s leading retail companies with a strong presence in eCommerce through its own operations and subsidiaries. However, recent market developments call into question whether Otto's eCommerce business can maintain its relevance.

The following insight elucidates what Otto’s eCommerce business consists of, why growth has slowed in recent years, and what Otto can do to reverse the trend.

The Otto Group’s eCommerce Businesses

What are Otto’s eCommerce businesses? On its flagship domain Otto, the company acts as both a seller and a marketplace provider for third-party products to be sold through.

But Otto is also active through a long list of subsidiary eCommerce companies. The most prominent of these include

About You, which was founded in 2014 as a subsidiary of Otto. Building on Otto’s technological know-how and infrastructure, About You joined the ranks of Germany’s top-performing fashion online retailers.

Bonprix is similar to About You in that it started as a subsidiary of Otto and is one of Germany’s top online stores. But Bonprix started much earlier, in 1986, and as a physical fashion retailer to which eCommerce later became an adjunct.

Crate & Barrel, a U.S. furniture & homeware retailer, which Otto became the sole owner of in 2011.

Other smaller retailers operating in various segments. These include the mail order companies Baur, Heine, Quelle, Ackermann, and 3Suisses, as well as other niche retailers like hunting equipment retailer Frankonia, the lingerie shop Lascana, or the private shopping club Limango.

A complete list of Otto’s eCommerce subsidiaries can be found on the corresponding ECDB Company Page.

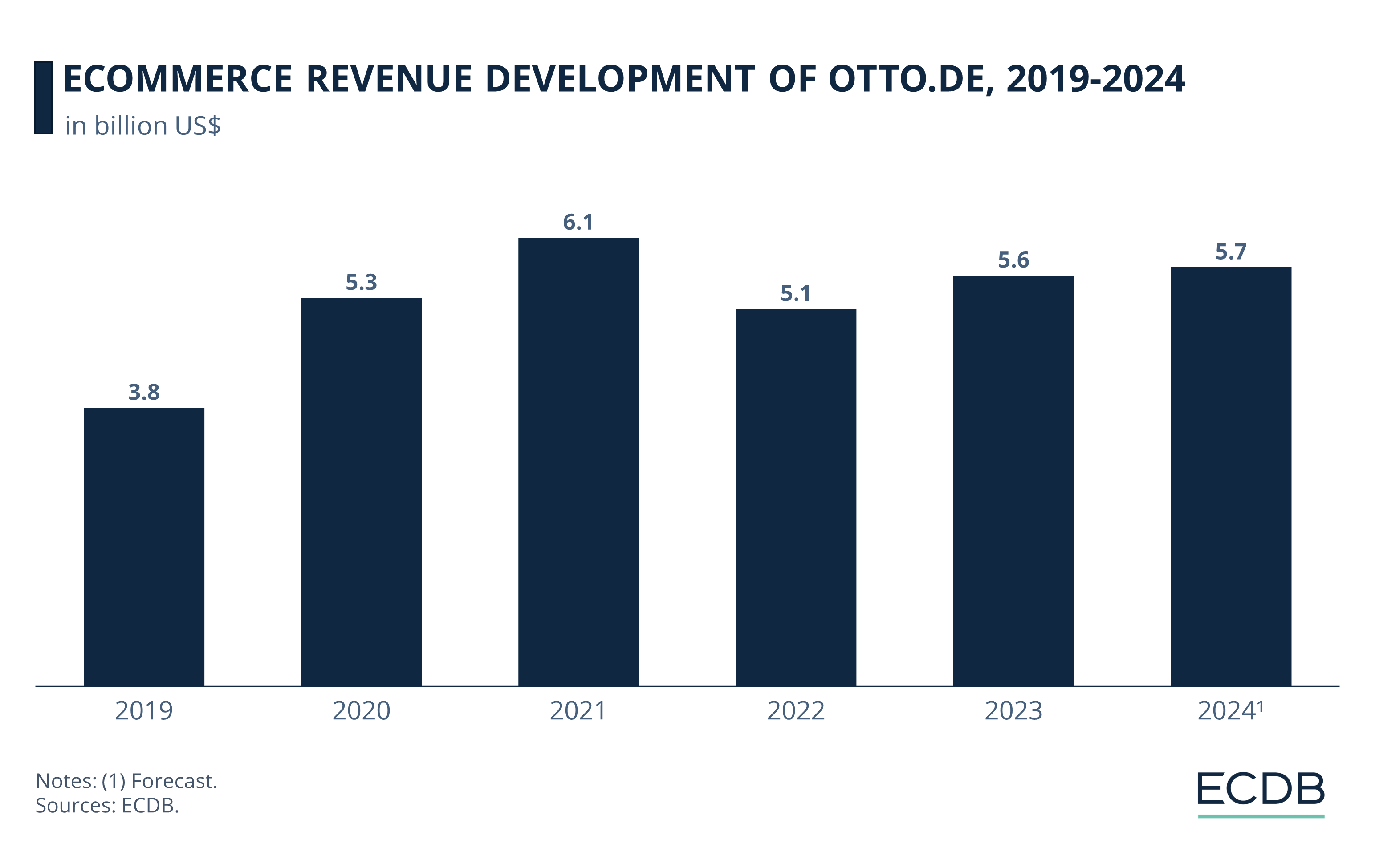

Otto.de’s Net Sales Account for 40% of the Group’s Total

Otto.de is the second largest online store in Germany and by far the conglomerate’s most profitable eCommerce business. But overcoming the pandemic slump has been difficult:

Online revenues peaked at US$6.1 billion in 2021, after steadily increasing since 2019 and online net sales of US$3.8 billion. This represents an average annual growth rate of 27%.

The post-pandemic normalization period from 2022 onwards led to a decline in revenues for otto.de: eCommerce net sales fell to US$5.1 billion and only recovered slightly in the following years. By 2024, ECDB analysts expect online net sales to reach US$5.7 billion.

Compare this to the eCommerce revenues of the entire conglomerate, of which otto.de contributed 40% in 2023:

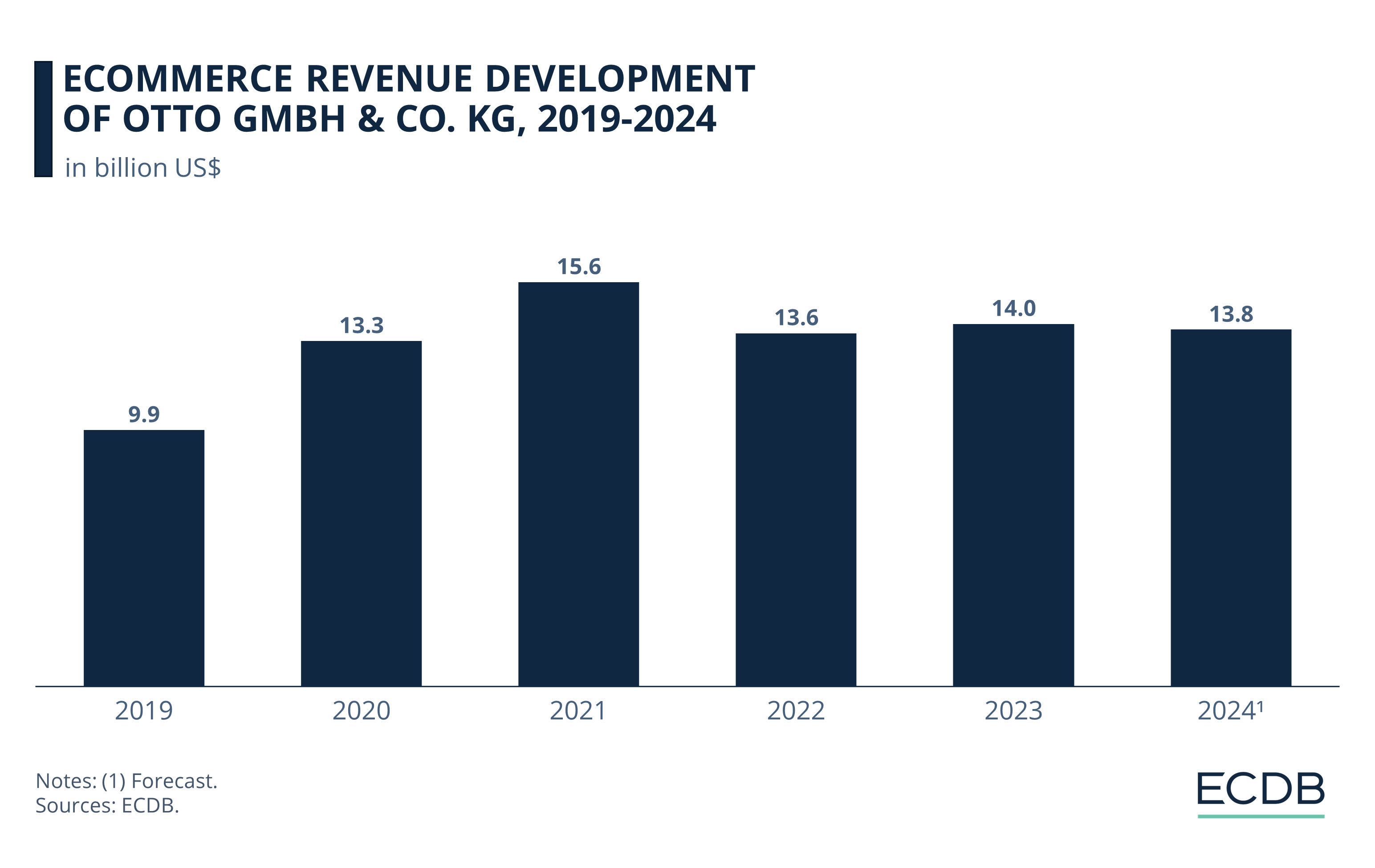

Otto GmbH & Co. KG’s overall eCommerce revenues followed a similar pattern to the ones its flagship otto.de experienced.

The conglomerate’s eCommerce revenues peaked at US$15.6 billion in 2021 and fell to US$13.6 billion in 2022.

While there was a slight recovery to US$14 billion in 2023, revenues are expected to decline again by 2024 with a forecast of US$13.8 billion.

With its diverse portfolio of businesses, Otto's revenues are spread across many domains and market sectors.

However, the conglomerate is struggling to keep up:

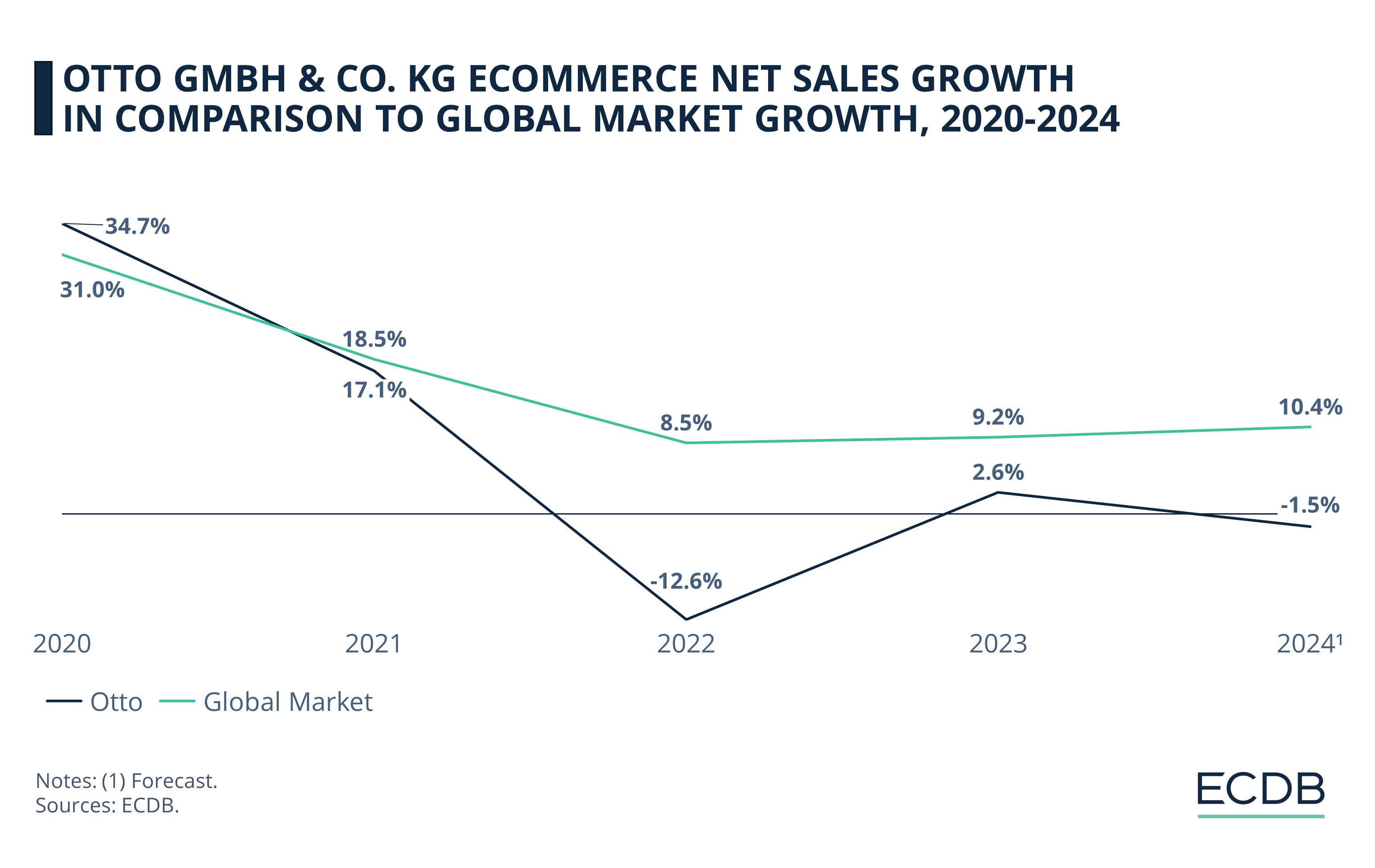

Otto Group’s Annual Growth Remains Behind Global Rate

A comparison between Otto Group’s annual growth rates and the ones observed in the global eCommerce market show that Otto struggles to keep up:

In 2020, Otto outperformed the global market in terms of annual growth, with a rate of 34.7% compared to 31% for the global market.

The situation reversed, however, in the following year: Global eCommerce grew by 18.5% year-on-year, while Otto’s rate was at 17.5%.

The year 2022 was particularly hard for Otto: Growth dropped to -12.6%, which stood against moderate market growth of 8.5% worldwide.

The subsequent years solidified Otto’s lag: With rates of 2.6% in 2023 and -1.5% in 2024, Otto cannot keep up with the market average of around 10% in both years.

There are several reasons for this, the most common of which relates to the highly competitive environment in which Otto operates:

Otto’s Competitive Environment: Competing With Amazon and Temu

As a generalist online retailer with both first- and third-party sales, Otto operates in a niche that is primarily dominated by Amazon. In addition, the market is currently being disrupted by the emergence of low-cost competitors such as Temu. The Asian model is based on gaining market share by undercutting incumbents on price and engaging customers with games and social media advertising.

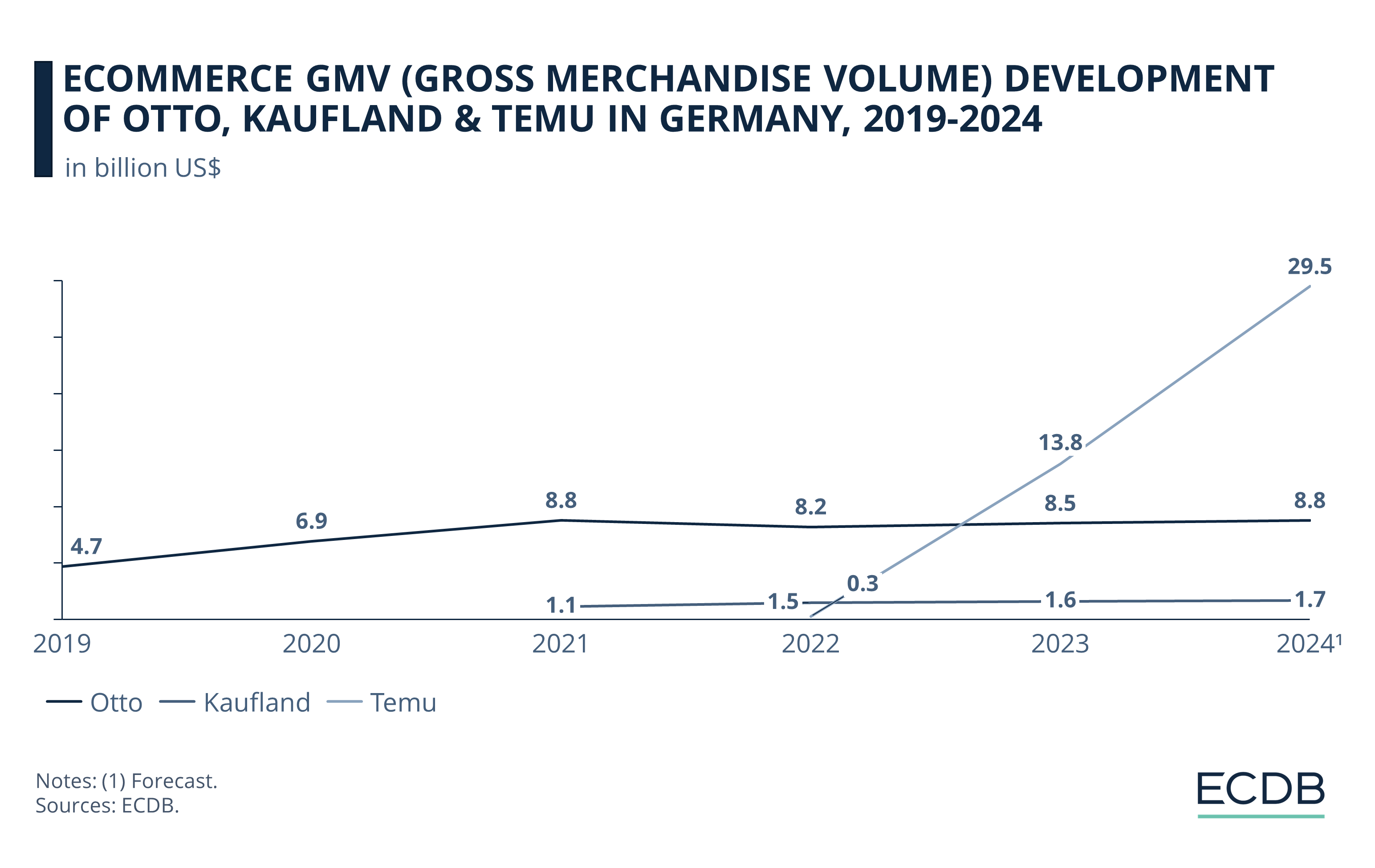

The ECDB Marketplace Ranking provides a benchmark for retailers of interest. In the German market, here is how Otto ranks alongside Amazon, Temu and Kaufland:

Amazon towers above the others, with a GMV of US$728.9 billion in 2023. Its global operations insulate it from economic shocks in certain regions of the world, and it is also by far the oldest of the four marketplaces.

Temu is the newcomer on the rise, run by China’s eCommerce giant PDD Holdings. It already surpassed Otto’s GMV in 2023, just one year after Temu’s launch. Germany is not even Temu’s main market, accounting for 7.6% of GMV.

Kaufland, a sister company of Lidl, is behind the others in terms of GMV (US$1.6 billion), and ranks on 87th place in German eCommerce. It is the only marketplace in our selection where Otto has the upper hand.

While Otto’s marketplace ranks third in German eCommerce in terms of GMV (US$8.5 billion) and is therefore well-positioned in the market, it is questionable whether this standing is sustainable.

Otto Stands the Middle Ground, But For How Long?

Look at the explosive growth of Temu compared to Otto and Kaufland in the chart below:

Otto has several problems that apply to its flagship online store, its marketplace, and the subsidiary domains through which it touches various industries.

1. Lack of Differentiation

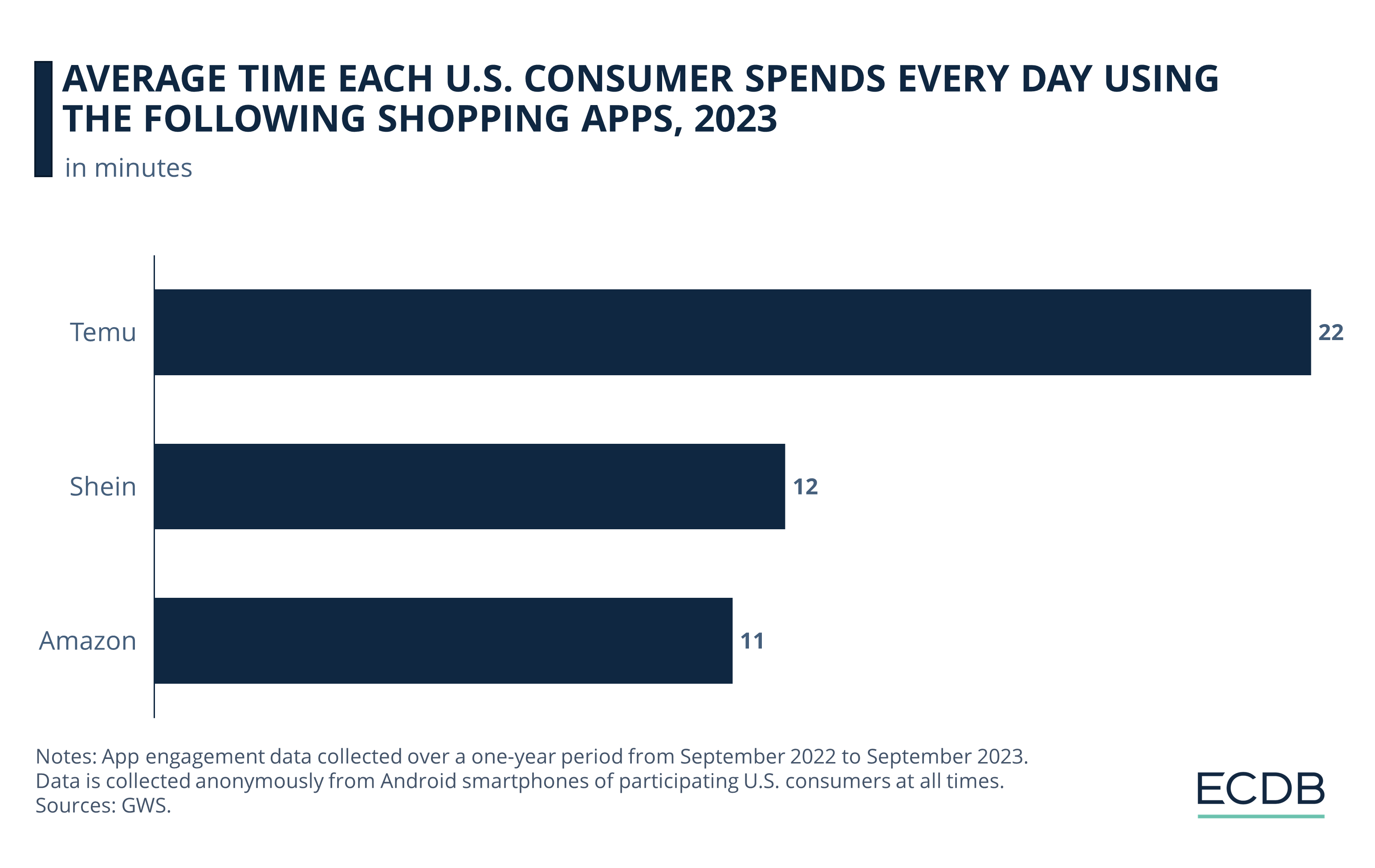

Otto is a generalist retailer, offering something of everything. While this increases the size of its product assortment, it also means that it is easy for consumers to switch to its low-cost counterparts. There is nothing really stopping users from browsing Temu instead of Otto, and because Temu engages through gamification and flashy rewards, consumers tend to spend more time there anyway:

2. International Irrelevance

As can be seen from the list of subsidiaries discussed at the beginning, a large part of Otto's portfolio consists of niche players, especially those operating abroad. A diversified portfolio of subsidiaries serves to protect conglomerates from over-reliance on one business or region, but if only a small portion of the subsidiaries generate the highest share of revenues, the dependence on these revenue drivers remains.

3. Outdated Company and Subsidiary Focus

This last point is related to the previous one. As a result of the acquisition of many struggling mail order companies, the online shops of players such as Baur or 3Suisses are not a competitive factor against the highly trend-oriented and low-cost assortment on which Temu or Shein operate.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Otto’s problems are therefore akin to what ASOS and Boohoo are struggling with in the UK eCommerce market. Acquisitions largely involved bailing out bankrupt retailers and niche players that contribute only small amounts to the group's overall revenue.

Otto In A Crisis?

Otto.de is facing serious challenges. In a matter of months, the platform has lost over 1,000 sellers, with many pointing to high fees and dissatisfaction as key factors. As Germany's third-largest marketplace behind eBay and Amazon, Otto must now focus on regaining sellers while contending with fierce competition from Chinese eCommerce giants like Temu and Shein.

Otto saw a mass exodus of sellers after raising fees earlier this year. Commissions on several product categories doubled from 7% to 15%, and the monthly base fee increased from 39 euros to nearly 100 euros—significantly higher than competitors like Amazon. As a result, over 1,000 sellers left the platform, unable to keep up with the steep cost hike.

What Can Otto Group Do to Reverse the Trend?

Temu's entry provides an opportunity for Otto to differentiate its platform from the disposable offerings of these newer players. On the other hand, Amazon's rising merchant fees make the market leader increasingly unattractive for sellers to list their goods there, which in and of itself is an opportunity for competing marketplaces.

Otto’s chances lie in:

Redefine itself as a higher-quality alternative to emerging players: Otto has the resources to stand out with an offering that provides quality at a reasonable price. Combined with a logistics network that caters to conveniences like fast delivery, Otto has the potential to become the go-to place for sellers and consumers looking for an Amazon alternative.

Investing in subsidiary businesses of the future: Instead of rescuing outdated mail-order businesses whose look and feel is behind the times, refocusing on trends like social commerce or quick commerce can ensure steady growth.

Being more intentional about sellers on the platform: Otto’s lead over platforms like Kaufland indicates that consumers value items that arrive intact, from sellers chosen for their trustworthiness and quality. For consumers, knowing where to turn when they are looking for reliability and convenience among the flood of dubious goods on other platforms is a strong competitive advantage.

Online is here to stay, and companies with an established brick-and-mortar network may be struggling to keep up. Otto GmbH & Co. KG has proven that it has the capabilities to ensure a satisfying online shopping experience, it just needs to apply them across the board to avoid being dragged down by excess weight.

Otto Group eCommerce Businesses: Wrap-Up

Otto faces a common dilemma for eCommerce incumbents in major economies: Stick to low-cost competition or adopt an approach based on quality and the right innovations? While the choice may be clear on the surface, it is more difficult to determine what works best in each individual case. At Otto, the high proportion of former mail-order companies and niche businesses is not necessarily an indicator of future growth.

However, there are still opportunities for positive development: An established logistics network and technological know-how are a clear competitive advantage. Add to this the opportunity to establish itself as a higher-quality alternative at fair prices through economies of scale, and you have a recipe for sustainable growth.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics